Over the years, we've accumulated a vast number of real cases and established a large list of clients worldwide, encompassing North America, Europe, Middle East, and other regions.

14+

Years of crafting apps

800+

Experienced employees

250+

Clients served

95%

Satisfied customers

Industry Leaders Trust Us

Insurance Solutions We Develop

Every insurance business has unique challenges. Being mindful of that, our developers create solutions to fit into your specific workflows. Upon request, we can provide you with any of the app types listed below or combine any of these features into a single solution.

Risk management apps

Take control of insurance risks with smart tools that detect, assess, and reduce them. Get real-time updates via analytics dashboards and spot issues early to avoid costly problems.

HIPAA-compliant health insurance apps

Effortlessly demonstrate HIPAA compliance with an app that continuously audits these and automatically updates your internal policies according to the latest regulations.

Insurance quoting apps

Process claims more productively by servicing a larger number of customers and offer personalized quotes based on the customer’s payment situation and credit history.

Insurance underwriting apps

Cut underwriting time from days to hours with a solution that balances compliance and risk management needs by auto-adjusting policies using real-time market and regulatory data.

Claims management apps

Speed up claims handling with an app that automates claims evaluation and management, offering features like ongoing fraud monitoring and alerts for faster, smarter processing.

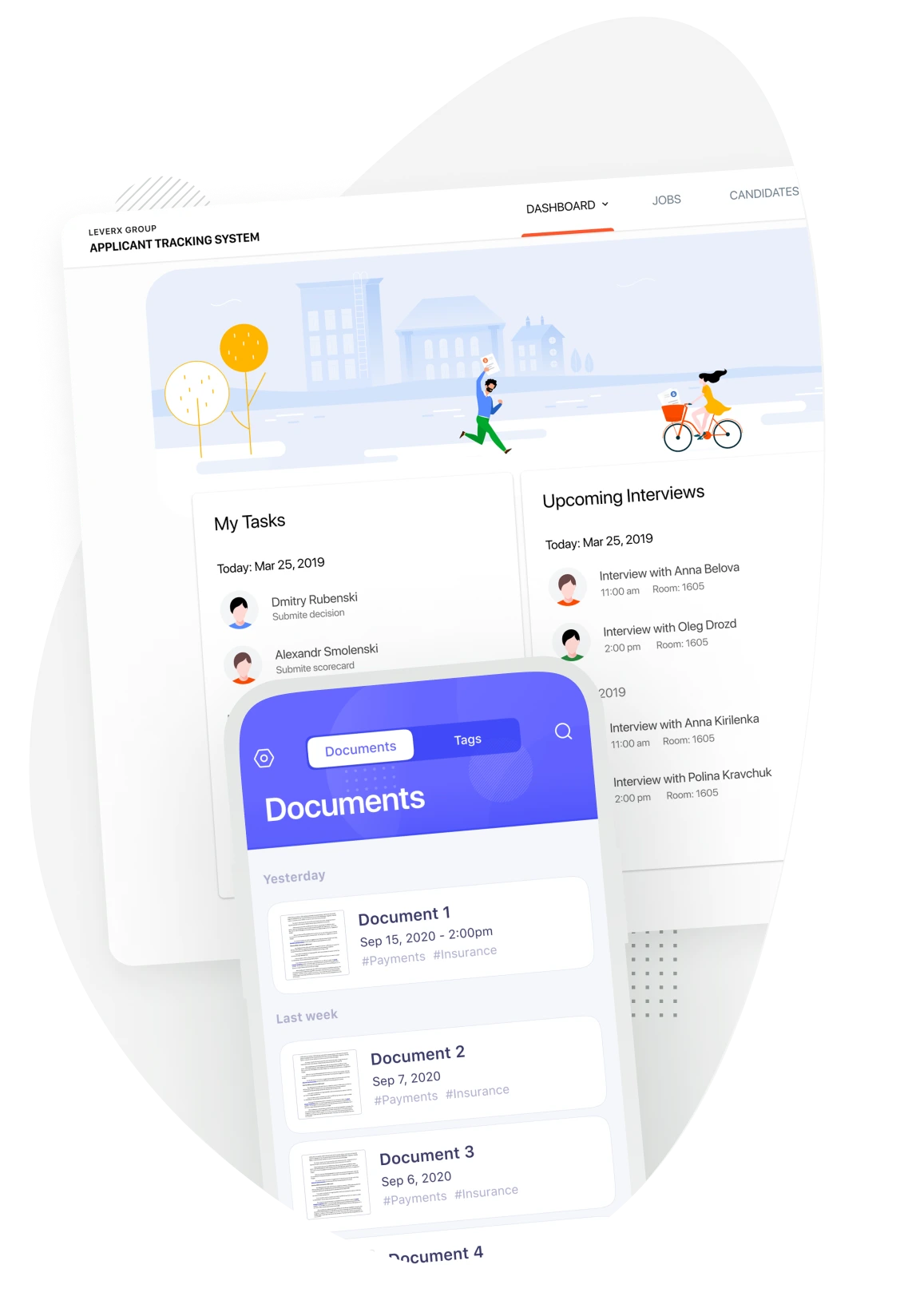

Document management apps

Manage documents more efficiently with an all-in-one system that allows users to collaborate in real-time, issue policies, review claims, and update information based on compliance alerts.

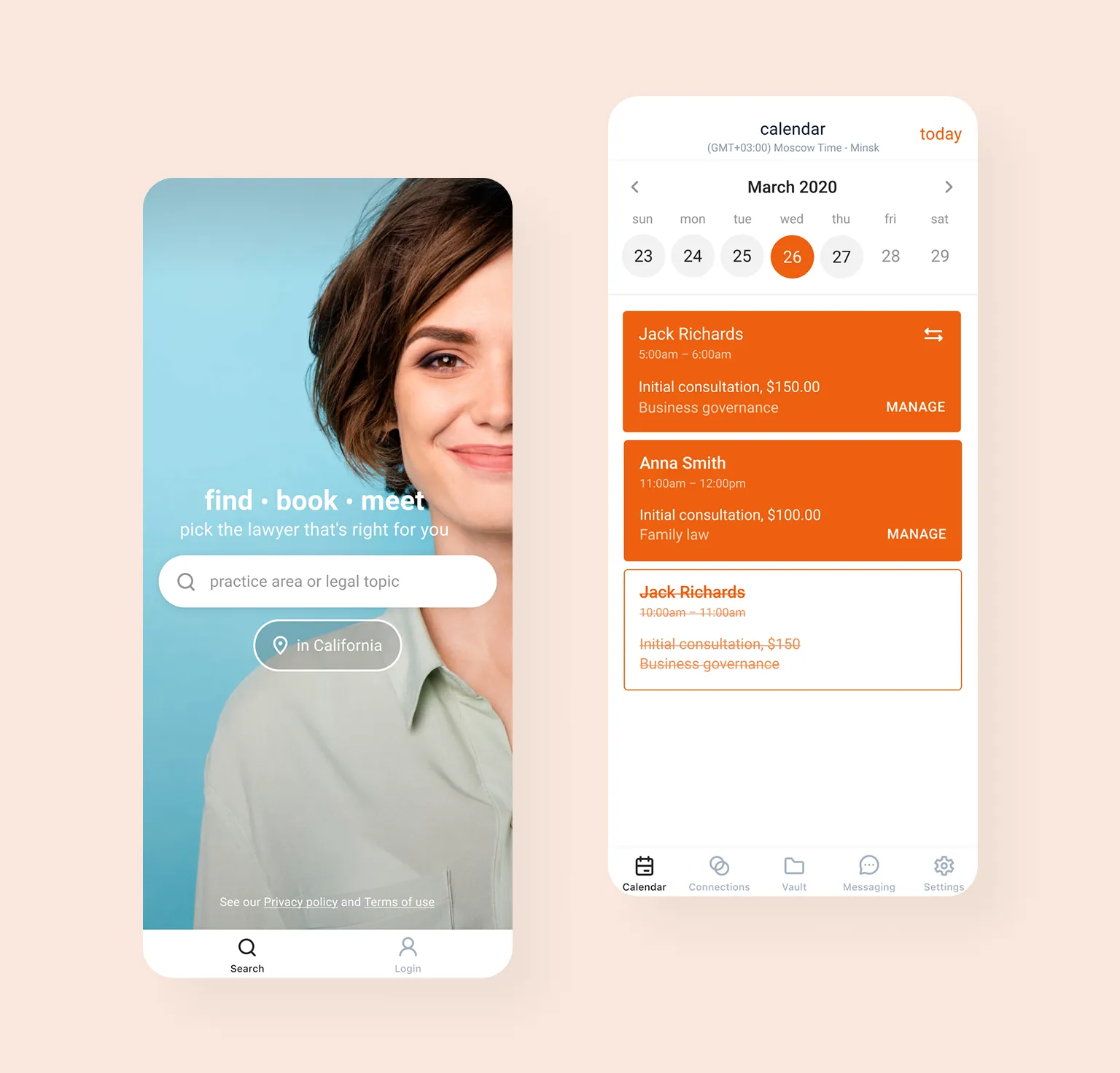

Insurance portals

Offer a single platform for agents, brokers, and clients to find the best counterparty deals based on the predefined parameters, make agreements, and track status in real time.

Car insurance apps

Enhance car insurance services with telematics software that analyzes how people drive, tracks collisions, and suggests policy changes and insurance premium calculations based on this data.

Life insurance apps

Deliver on-time life insurance service with an app that calculates person-specific rates, provides live support via virtual help desk agents, and notifies them about policy updates.

Property insurance apps

Protect property owners with tailored coverage plans based on unique needs and finances. A companion app lets users file claims anytime, anywhere - without going to an agency.

Travel insurance apps

Cut travel risks and unexpected costs with an app that lets users file claims instantly from anywhere via a digital form and track status easily with real-time alerts.

Digital wallets

Ensure fast and secure in-app payments with integrated digital wallet functionality. Alternatively, you can build a standalone digital wallet app for payments.

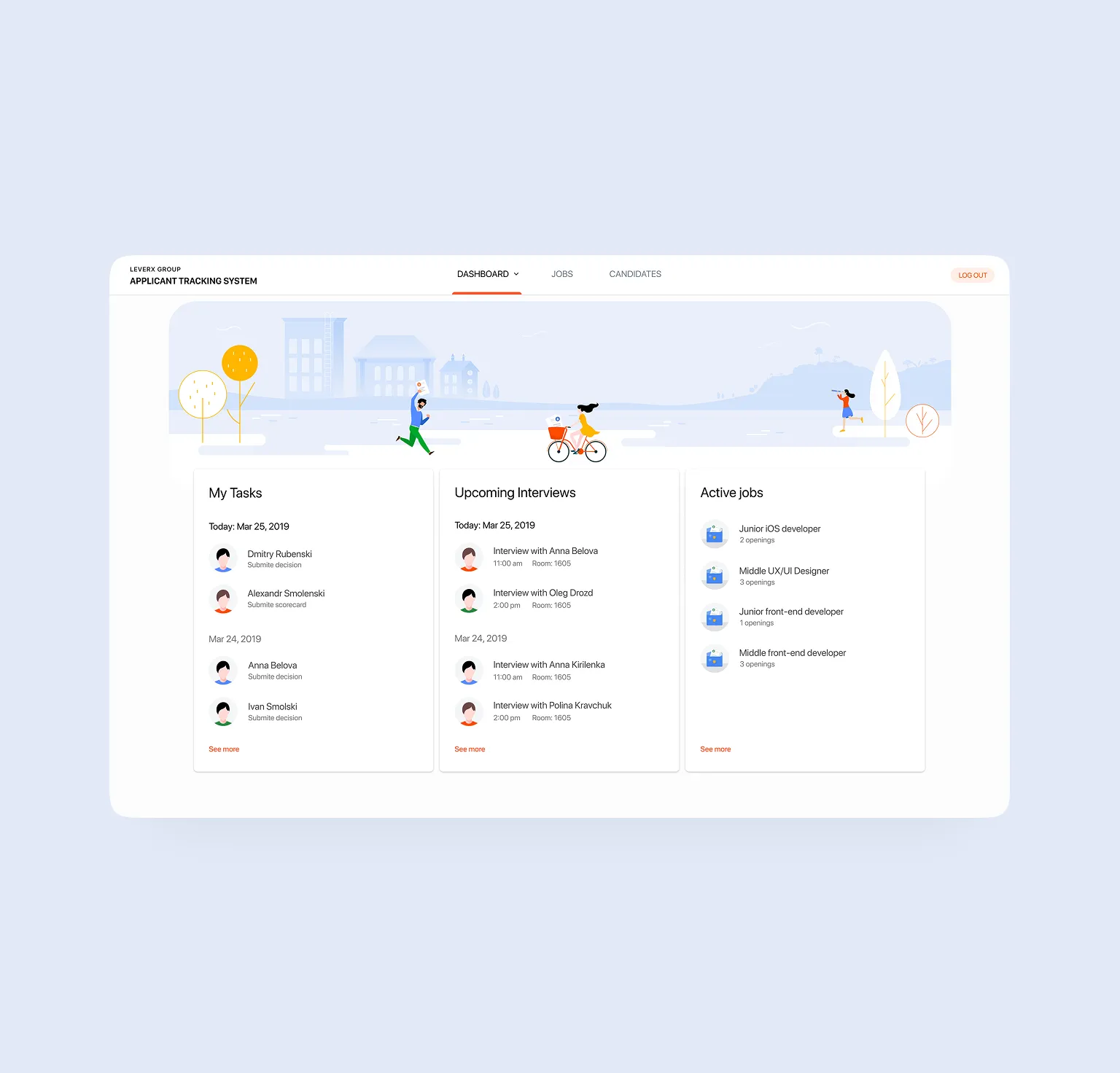

Streamlined Insurance App Development for Every User

Our insurance apps are designed to simplify and enhance every aspect of the insurance journey. From user-friendly experiences to powerful tools for agents and administrators, we provide a fully integrated system tailored for modern insurance businesses.

Challenges We Tackle With Custom Insurance Apps

In our work, we always aim to be farsighted when selecting a proper insurance app for each client. Above all, we gain deep insights into the industry to identify “gaps” that we can close with our apps. Below, you can see major insurance industry challenges and how we solve them.

Slow claim processing

We equip your app with claim automation functionality, allowing you to handle customer applications more efficiently. With Emerline's advanced solutions, the system will autonomously approve or reject claims based on the predefined application criteria and send you alerts.

Lack of data for market & customer analytics

Leverage the power of AI and ML to build predictive models that ramp up your entire operation! With these, you can proactively anticipate financial risks and optimize prices accordingly, identify dropout risks, and create personalized proposals for dissatisfied customers.

Standardized coverage terms

Reach a broader clientele with AI-powered solutions that enable real-time analytics of each customer’s payment behavior and credit history to offer personalized insurance packages. As a result, you can cut customer acquisition costs and ensure predictable profits.

Fraud schemes

Minimize fraud risks with real-time monitoring tools we can embed into your app. These save you the trouble of performing a continuous manual validation as they autonomously detect suspicious user behavior, alert you to findings, and reject claims defined as fraudulent.

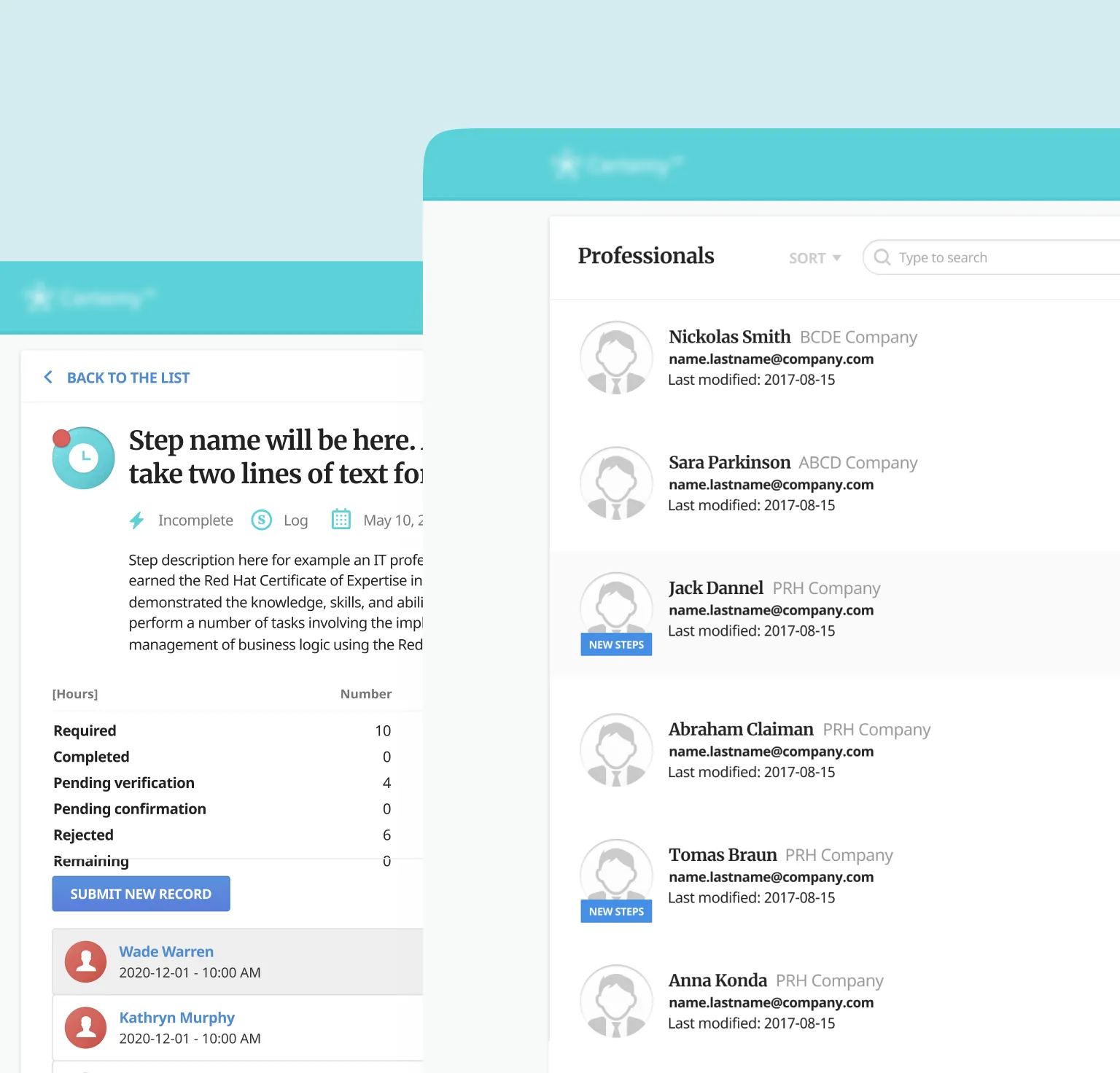

Emerline’s Expert Insurance App Development Services

As the true experts in insurance app development, we take care of your project end-to-end, from business analysis to delivery and support. We manage projects of any complexity, providing transparent feedback at every step of the delivery process.

Business case exploration

MVP development

Custom insurance app development

Insurance mobile app development

UX/UI design

Customization & API integration

Maintenance and support

Leverage Innovative Technologies for Your Insurance App

Chatbots

Boost engagement and cut response time with chatbots — provide instant support, streamline queries, and guide users through insurance policies.

Data analytics

Leverage data analytics to uncover user insights, track performance, and make informed decisions that drive growth and improve app efficiency.

AI agents

Use AI agents to automate routine tasks, speed up claims processing, and deliver tailored support — freeing up human agents to focus on complex cases.

AI

Leverage AI to automate claims processing, issue personalized policy recommendations, and enable real-time fraud detection. AI helps streamline operations, improve accuracy, and enable smarter decision-making.

Stay Compliant With Industry Standards

Emerline’s experts ensure the full compliance of your insurance procedures with the relevant regulatory requirements.

IFRS 4 (International Financial Reporting Standard)

We ensure transparent and consistent financial reporting in line with IFRS 4 to support accurate policy valuation and risk assessment.

IDD (Insurance Distribution Directive)

Our apps are built to meet IDD requirements, ensuring fair treatment of customers and full transparency throughout the insurance distribution process.

HLA (Higher Loss Absorbency Requirements)

We support insurers in meeting HLA requirements by integrating risk management tools that enhance capital adequacy and loss resilience.

PRIIPs (Packaged Retail and Insurance-Based Investment Products)

We enable full PRIIPs compliance with features that generate clear, standardized disclosures to help consumers understand investment risks and costs.

ComFrame

Our platforms are designed with ComFrame in mind, supporting consistent supervision, governance, and risk-based assessments across jurisdictions.

ISO 27001

We follow ISO 27001 standards to implement strict data security measures, protecting sensitive customer information across all digital touchpoints.

Why Emerline?

Profound insurtech expertise

With a long history of developing insurance software, we can build a custom solution for any platform and environment, be it desktop or mobile. Alternatively, we can develop a cross-platform application that provides a seamless user experience across devices.

Security comes first

When developing insurtech apps, we emphasize the security of your operations. All insurance solutions we deliver have fraud detection and compliance monitoring tools and come with advanced authentication algorithms by default.

Adherence to the industry standards

Staying current with the latest trends and standards in the insurance industry, our team of experienced business analysts and software engineers ideate and provide best-in-class solutions that help you gain a competitive edge and maintain compliance at all times.

Best value for money

Whether you are a startup with limited resources or a business focused on quick time to market, we will help you realize your idea by delivering a cutting-edge insurance app, while staying within budget and ensuring quality.

The individuals we work with aren't just contractors, they are an important part of our strategic Team and we enjoy working with them every day!

Emerline has been our technology partner since late 2012. In the early years I thought that would be a short-term gap fill until I could afford to hire my own technical team in the US. But they have consistently met the demands of our growing company and helped us build what we believe is the industry's best solution option. Emerline provides high quality work, so much so that our platform's reliability and accuracy has been mentioned by our largest customer's internal vendor survey repeatedly. The individuals we work with aren't just contractors, they are an important part of our strategic Team and we enjoy working with them every day!

President/CEO, CPG Data

country

USA

company

CPG Data

project summary

Extensive sales analytics platform aimed at facilitating the work of distributors and maximizing their performance.

solution category

Analytics and Reporting Software

industry

Supply Chain Management

Emerline has been the best development partner we’ve ever worked with!

Emerline has been the best development partner we’ve ever worked with. The team is very responsive and the quality is very high. They are always willing to do whatever is necessary to support development and customer support efforts. I would recommend them to anyone.

CEO, Praxie

country

USA

company

Praxie

project summary

Online collaboration solution to boost team’s productivity and efficiency

solution category

Innovations Management

industry

Business Process Management Software (BPM)

We recommend Emerline as a trusted technology partner for developing telemedicine solutions and would choose to work with Emerline again regarding new projects.

We can confidently say that Emerline fully met our expectations, starting with providing high-quality advice on technologies that would improve our solution and continuing with their fast, high-quality implementation. Emerline has strong communication processes in place that kept us apprised of the project's stage and allowed us to discuss any issues on the go. The team was professional and promptly made adjustments when asked. We recommend Emerline as a trusted technology partner for developing telemedicine solutions and would choose to work with Emerline again regarding new projects.

Founder, Hello Ralphie

country

USA

company

Hello Ralphie

project summary

Development of a web solution to connect pet owners with vets for the provision of remote diagnosis and care.

solution category

Vet Telehealth

industry

Healthcare

Emerline provided us with the scaling we needed to grow our development capabilities from early-stage POC to now a globally deployed platform in the HR Teach space.

We are very pleased and content with our relationship with Emerline. We rely on their team for full-stack development of our platform. We respect the high technical caliber and dedication of the team assigned to our project. Emerline provided us with the scaling we needed to grow development capabilities from early-stage POC to now a globally deployed platform in the HR Teach space.

CEO, Espresa

country

USA

company

Espresa

project summary

A culture benefits platform delivering an immersive employer experience

solution category

Human Resources

industry

Human Resources Management Software

We highly recommend Emerline as a technology partner for large and complicated development projects that also delivers continuous cooperation with the provider on new projects.

The Emerline team involved in the completion of our projects demonstrated a high level of responsiveness and support by solving issues and answering questions ASAP. They were diligent and proactively addressed the challenges that arose during the development process. Our cooperation ran smoothly and professionally, and Emerline quickly provided direct and correct advice when necessary. We highly recommend Emerline as a technology partner for large and complicated development projects that also delivers continuous cooperation with the provider on new projects.

VP Global IT, FUCHS Group

country

Germany

company

FUCHS Group

project summary

Advanced Global Platform for a Large Manufacturer of Industrial Lubricants

solution category

Analytics and Business Intelligence Platforms

industry

Manufacturing

Emerline helped us build an MVP into a full-fledged production platform — in 14 months

Emerline worked closely with us to take the best ideas from our MVP and integrate them with transactional capabilities for digital payments, workflow for job management, and funds transfers for cash advances. Our platform was built to service the roofing industry getting contractors paid faster so they can focus on growing their businesses and servicing their customers.

Founder and CEO, SquareDash

country

USA

company

SquareDash

project summary

Helping an ambitious fintech startup build up its MVP to a full-fledged production platform — in 14 months

solution category

Automated Platform

industry

Fintech

Throughout our cooperation with Emerline, they proved themselves reliable technology partners.

Throughout our cooperation with Emerline, they proved themselves reliable technology partners. That’s why we trusted them with our new project — website migration to AEM and revamping our brand’s product catalog that we use across multiple websites — without any hesitation. The team always stayed in touch, providing regular feedback and progress updates. The cooperation was smooth, and the work on the project was completed in due time. They provided an efficient solution that allowed us to reduce infrastructure costs; with it, we didn’t have to depend on third-party vendors. Thanks, Emerline! We will definitely continue working with you.

IT Director

country

USA

company

DRiV

project summary

Emerline performed a comprehensive migration of the client’s website to AEM and completely revamped the client brand’s product catalog across multiple websites.

solution category

Websites migration, Data migration and integration, Production support

industry

Large manufacturing enterprise

Emerline exceeded expectations with organized, forward-thinking, and committed teamwork. We’re proud of what we built together!

Redesigning our website wasn't just about updating our look — it was about building a stronger front door for the world to experience Miami’s economic story. As the official EDO for Miami-Dade, we knew the stakes were high. Emerline exceeded expectations. They were consistently organized, forward-thinking, and committed. In less than six months, we had a completely new platform — faster, smarter, and built to grow with us. We’re proud of what we built together!

President & CEO, Miami-Dade Beacon Council

country

USA

company

Beacon Council

project summary

Development of a fast and user-friendly website that supports сustomer’s digital marketing efforts.

solution category

Website design and development

industry

Business development

The team gladly brought their expertise and delivered us a perfect solution to meet our customers’ business needs.

The Emerline team wasn’t scared of any challenges and managed to design a solution to cater to any analytical or supply chain tasks. Their enthusiasm and process transparency ensured seamless communication and prompt reaction to any adjustment or focus shift from our side. Their experience and dedication allowed them to provide the solution really fast. We highly recommend choosing Emerline as a development partner if you need a high-end solution for your business.

Founder & CEO, Kontango

country

USA

company

Kontango

project summary

PoC and development of the market intelligence software for underserved commodities trading.

solution category

Market intelligence software

industry

Chemical, Supply Chain Management

We recommend Emerline as a reliable and skilled tech partner

Collaboration with Emerline was one of our best decisions! Their team quickly understood both the technical requirements and the industry-specific challenges we were trying to solve. We needed a secure, flexible platform that could support data-driven formulation across different industries, and Emerline delivered exactly that. Their team approached the task with professionalism, understood our goals, and built a solution that met both technical and user-facing needs.The result is a working platform that reduces manual work, speeds up R&D, and supports faster, smarter formulation processes across various industries. From day one, communication was smooth, timelines were clear, and we felt fully supported throughout the project. We highly recommend Emerline as a tech partner for your future initiatives.

FastFormulator Key Partner and Project Leader

country

USA

company

FastFormulator

project summary

Emerline developed a custom AI tool that enables companies to train models on their own formulation test results, speeding up R&D processes in the chemical and cosmetics industries.

solution category

AI, ML

industry

Chemical industry

They consistently delivered items on time, highlighting their commitment to timeliness and organization.

Emerline demonstrated a deep understanding of the client's vision, delivering a functional MVP on time and within budget. The team was highly responsive to the client's needs and maintained clear communication throughout. Above all, their exceptional project management skills stood out.

CEO, Founder of Tribela GmbH

country

Germany

company

Tribela

project summary

Emerline designed and developed a prototype product for a social networking company. They also conducted a business analysis with a comprehensive plan and scope for the MVP.

solution category

Social Network

industry

Media & Entertainment

The level of skill and quality of the developers is outstanding!

Emerline has been helping the client significantly improve their apps for 1.5 years. Their efforts have resulted in positive feedback from users and stakeholders. Moreover, the vendor impresses the client with their skills, flexibility, excellent project management, and effective communication.

Director, RedWrasse Ltd.

country

UK

company

RedWrasse

project summary

Emerline assists an IT consulting firm in various app optimization and management projects, including resolving bugs and issues, integrating a search engine into a database app, and revamping an app's codebase.

solution category

App optimization and management projects

industry

IT consulting

It was noteworthy to highlight the friendly and customer-oriented processes used for product development.

Emerline helped the client deploy the mobile app on the app store. Their team impressed the client with their transparency, proactiveness, and customer-oriented processes. They informed the client about any issues and addressed them swiftly, positively affecting the product quality and work speed.

CEO & Founder, Visible

country

Switzerland

company

Visible

project summary

Emerline helped a telepresence manufacturer develop their hardware device's web server and companion mobile app. They designed the UI/UX designs and added several key integrations using Swift and Core Data.

solution category

Mobile Application

industry

Manufacturing

My experience with Emerline has been great. I highly recommend them to anyone looking for a reliable partner who delivers on time and on budget.

The team was hired to design and develop the Echospectra mobile and web applications, as well as to integrate them with a variety of cloud services. A critical requirement was to rapidly develop the apps in an agile manner, quickly implementing important stakeholder and user feedback as it came along, and fixing any outstanding bugs. The team managed to accommodate this kind of agile, change-driven process successfully. Thanks to their rapid development approach, we've been able to build the initial app versions and then continuously iterate on them to refine our product offering and make sure it meets and exceeds customer expectations. I highly recommend them to anyone looking for a reliable partner who delivers on time and on budget.

CEO, Echospectra

country

USA

company

Echospectra

project summary

An innovative spatial data collection and collaboration platform that helps customers improve safety and resilience of critical energy networks. The solution combines field data with satellite imagery, and uses machine learning to help companies intelligently manage their energy assets, stay compliant, and mitigate risks.

solution category

Spatial Data Collaboration and Process Management Platform

industry

Energy

Emerline has enhanced our software to become an indispensable tool for all our staff.

They were very successful in listening to what we needed, making the appropriate suggestions, and pointing us in the right direction. They helped move our software from an awkward and crashy program to one that we depend on everyday. We couldn't do what we do without it.

Business Director, 3QC, Inc.

country

USA

company

3QC

project summary

Emerline has developed software that enables an engineering commissioning firm to assign resources efficiently. They've overhauled the client's base software platform and enhanced it based on their requests.

solution category

Custom Software Development

industry

Engineering