From the outset, SquareDash knew they needed to validate their idea and evaluate potential demand. SquareDash started with a basic open source expense and payments solution to create a minimal viable product (MVP), which was then used to measure product-market fit and validate their ideas.

While the MVP results were promising, it became obvious that the underlying solution came with limitations and constraints. In the future, these constraints could hamper product development and limit customizations that would be necessary to create a great product and customer experience for contractors and property owners.

SquareDash realized they needed a long-term technology partner to re-architect and rebuild their MVP, without any inherent tech limitations that would prevent future development of their product.

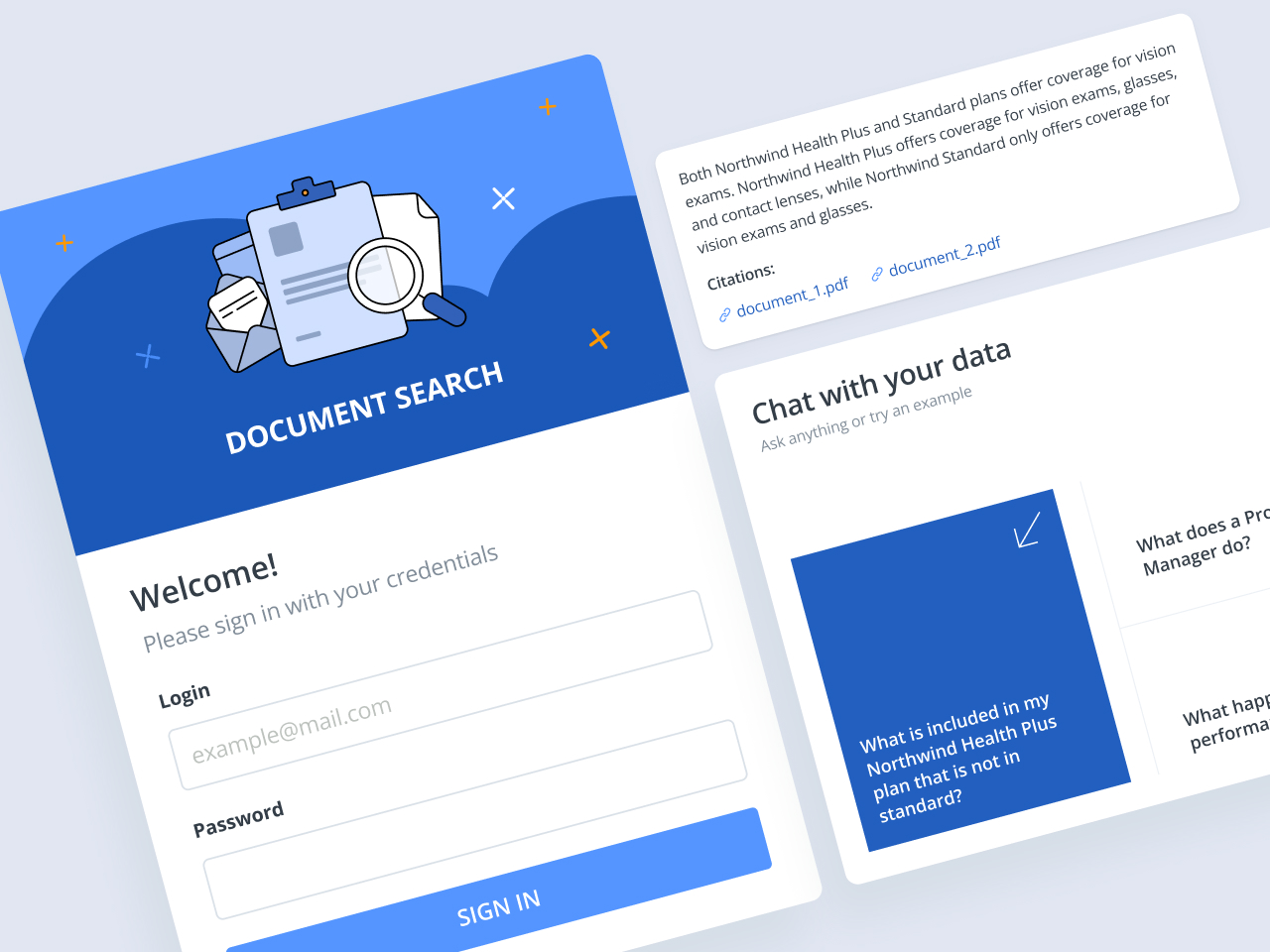

When deciding to build the next version of their payments and cash advance platform, SquareDash was looking for a collaborative software development partner with experience in delivering Web applications across multiple industries. Fielding a complete team of Business Analysts, Engineers, and Designers was also very important. Emerline met all the important criteria for SquareDash.

Emerline helped us build an MVP into a full-fledged production platform — in 14 months

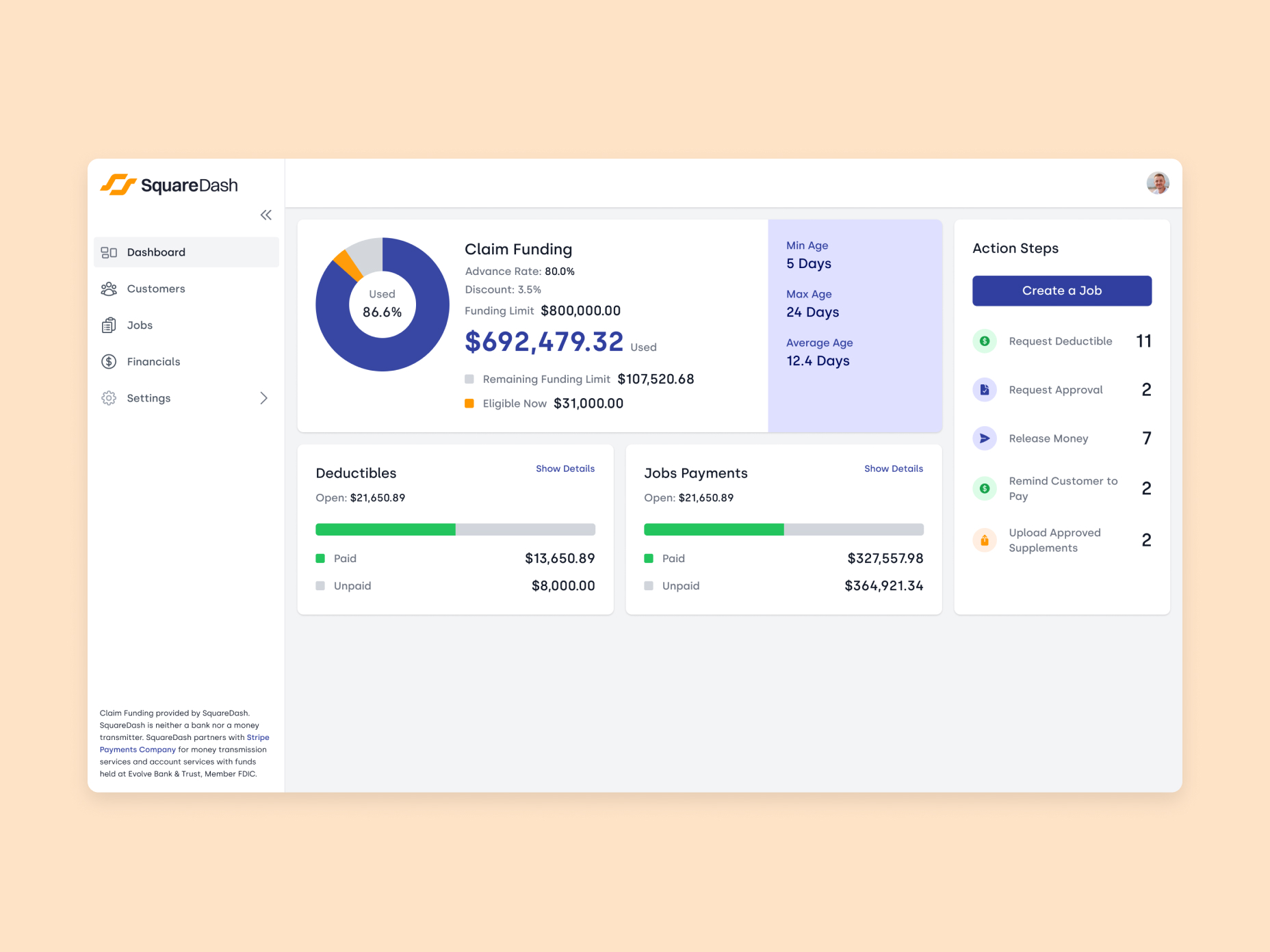

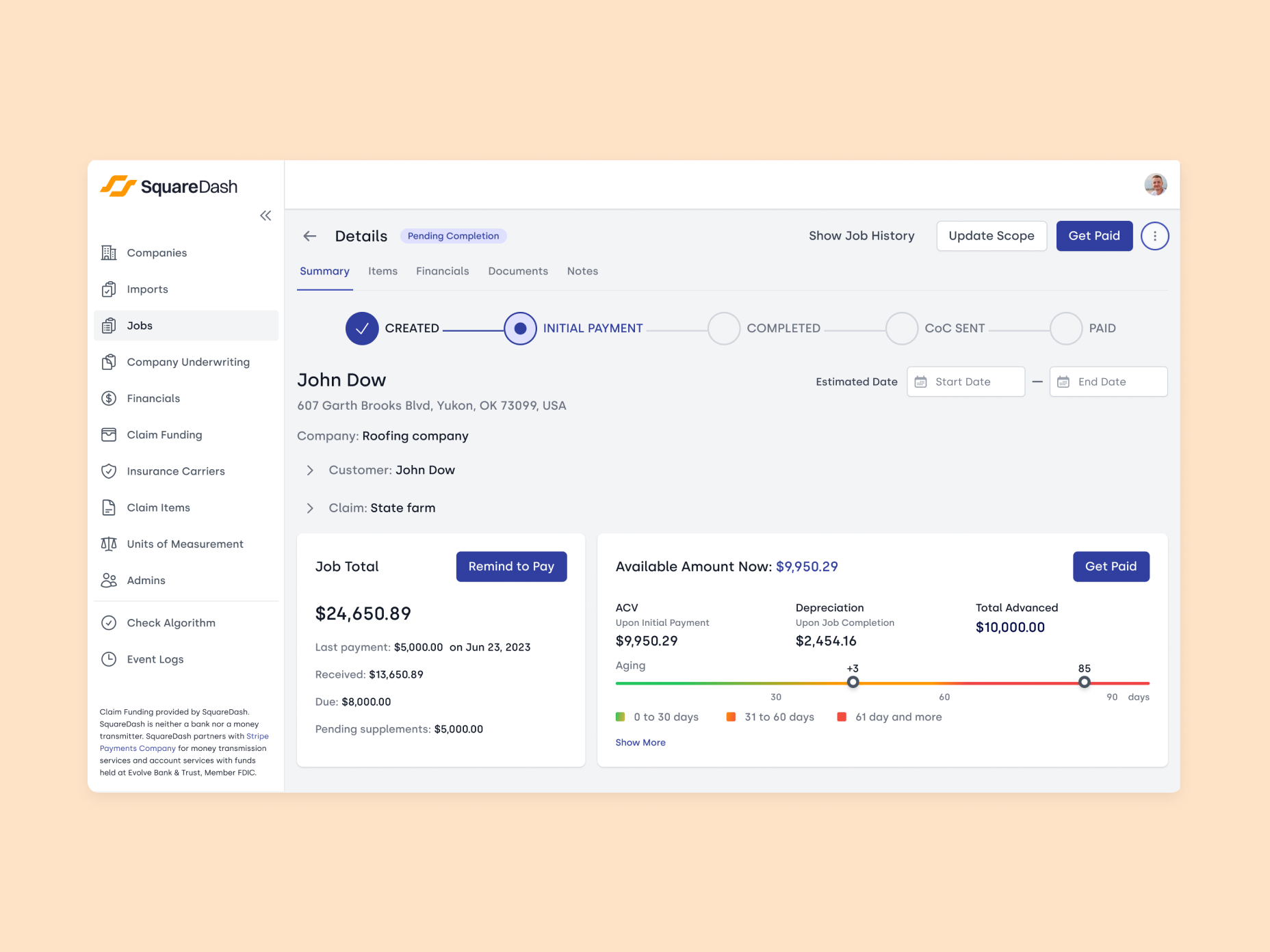

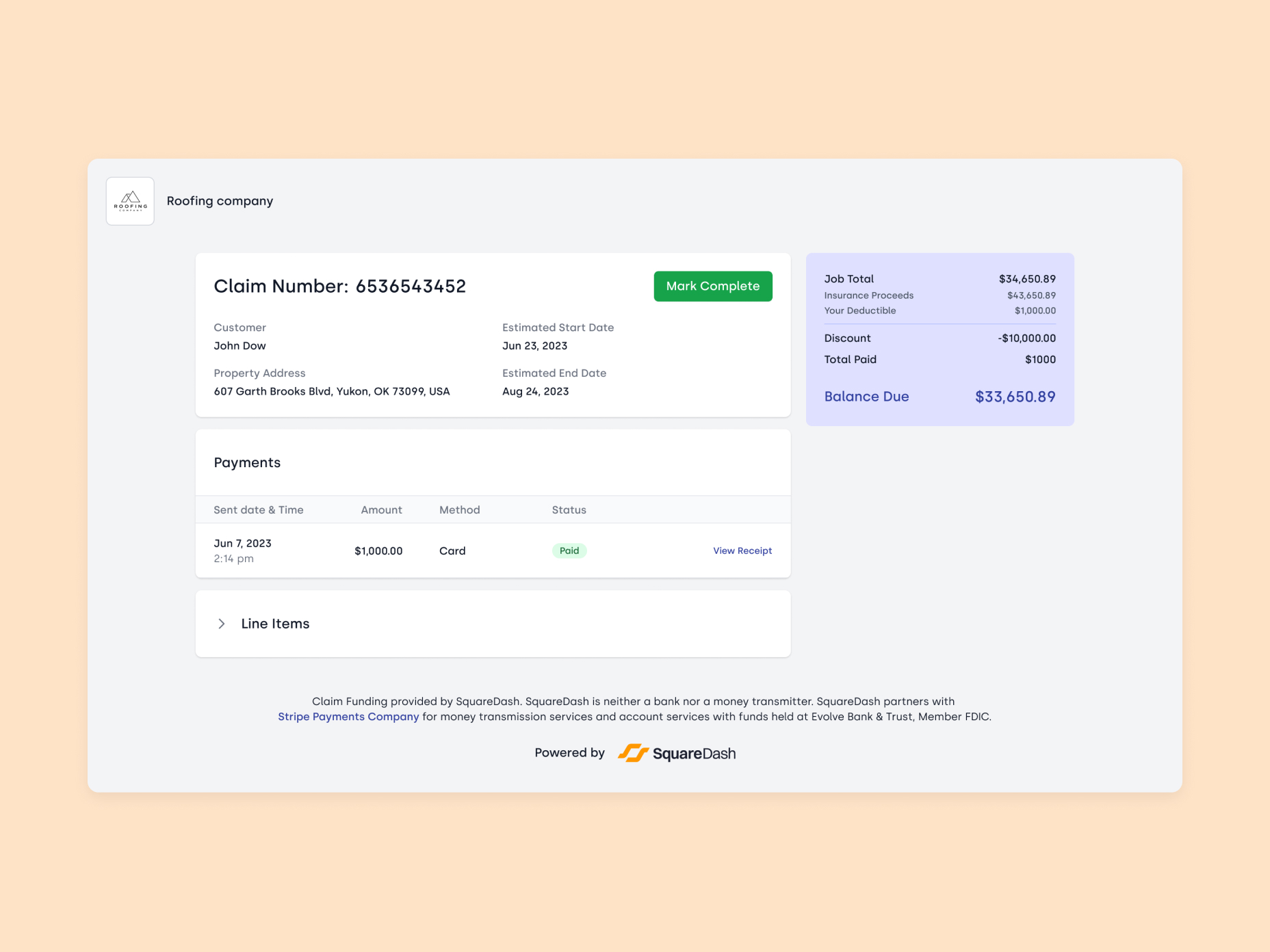

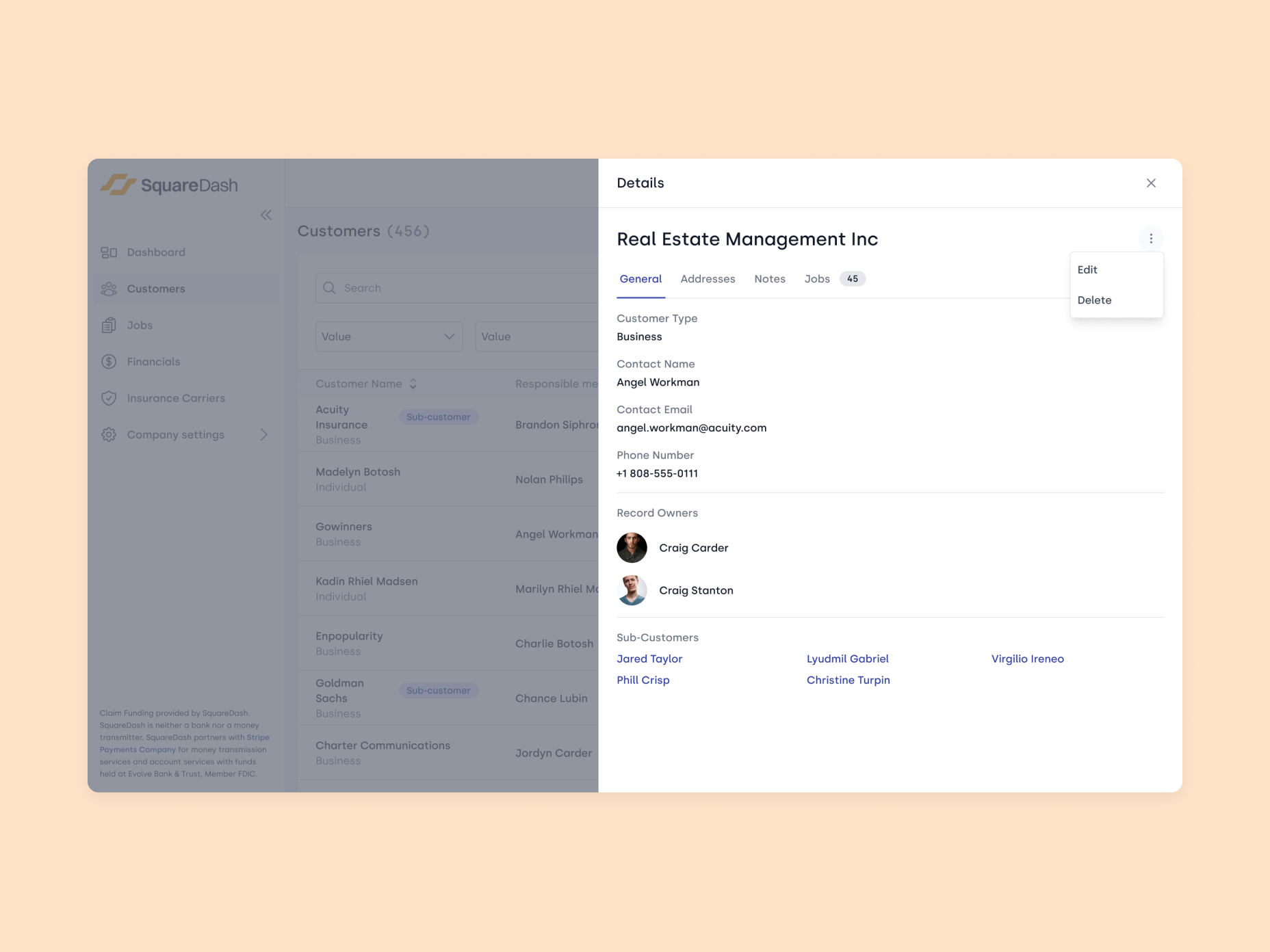

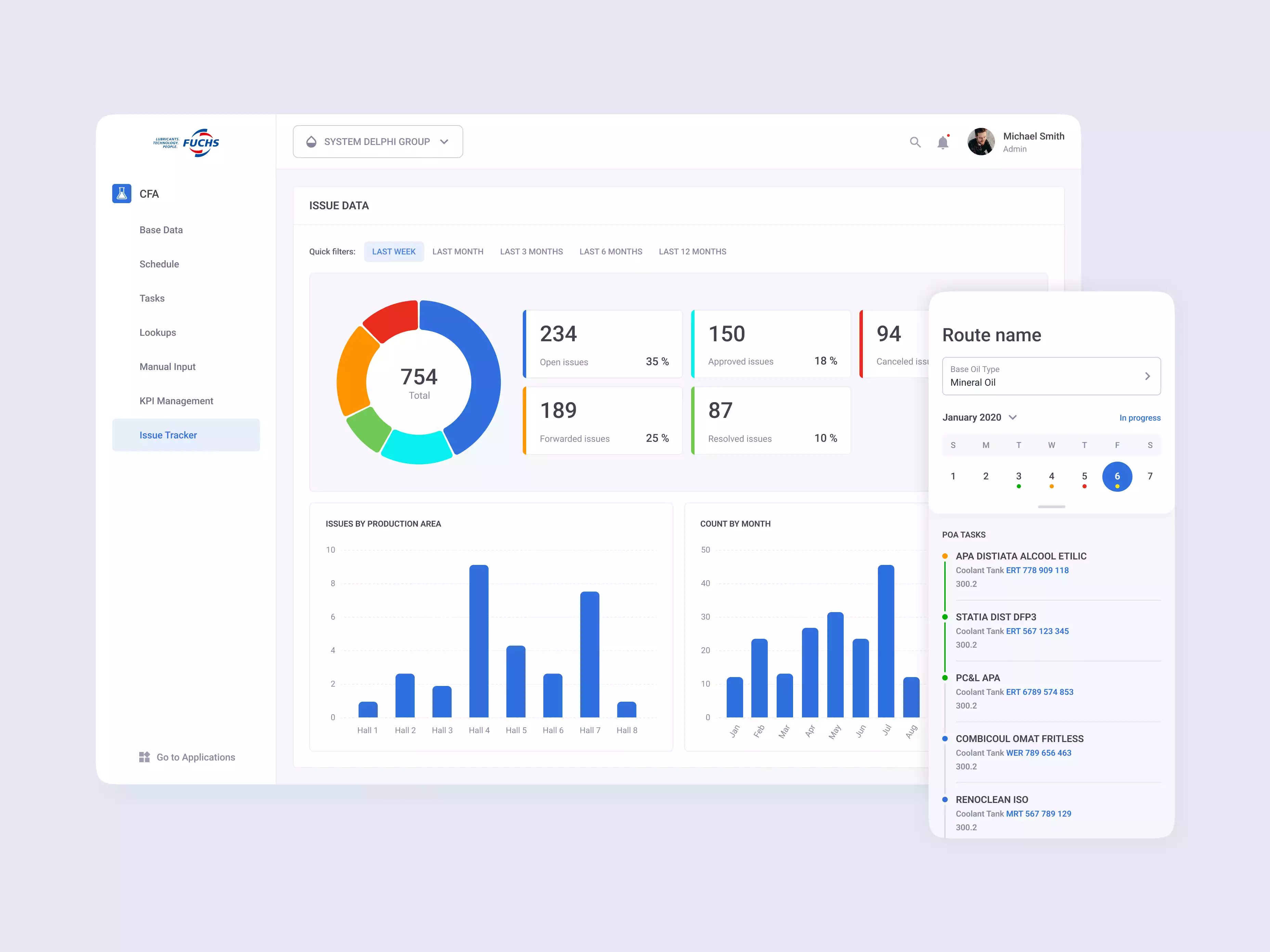

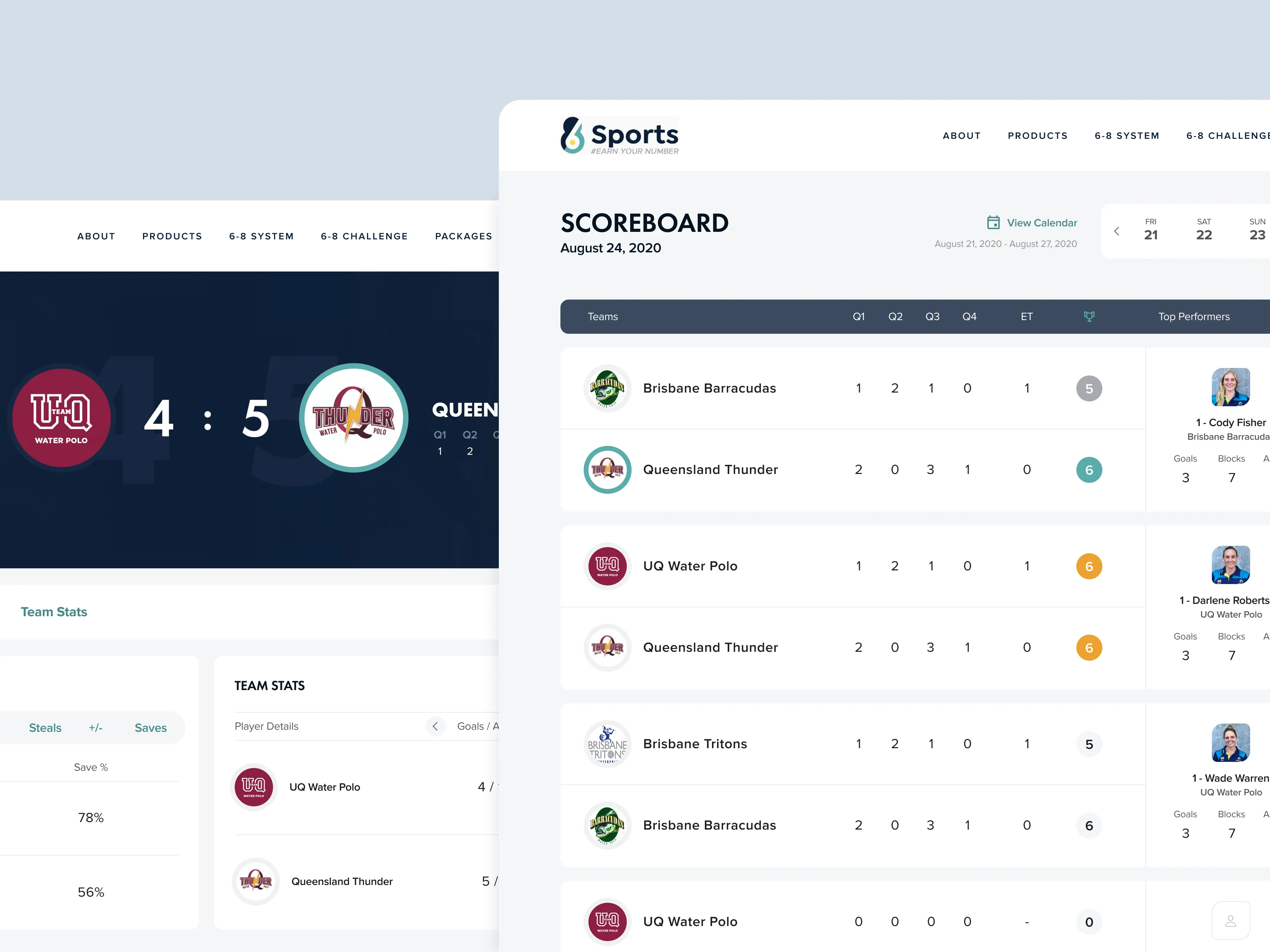

Emerline worked closely with us to take the best ideas from our MVP and integrate them with transactional capabilities for digital payments, workflow for job management, and funds transfers for cash advances. Our platform was built to service the roofing industry getting contractors paid faster so they can focus on growing their businesses and servicing their customers.

Founder and CEO, SquareDash

country

USA

company

SquareDash

project summary

Helping an ambitious fintech startup build up its MVP to a full-fledged production platform — in 14 months

solution category

Automated Platform

industry

Fintech