The Future of AI: A Vision for 2025–2030

Table of contents

- Growth of the AI Market

- Overall Market and Growth Potential

- Regional AI Markets: Comparison, Forecasts 2025 - 2030

- North America (USA)

- Asia-Pacific (China)

- Europe (EU)

- Other Regions of the World (ROW)

- The Race for Talent – The New Bottleneck

- Hardware as a Fundamental Resource

- The Chip Market, Capital, and Vertical Integration

- Critical Barrier – Energy and Environmental Footprint

- Decentralization through Edge AI

- The Problem of Trust and Data Quality

- Hyperautomation and Hidden Risks

- Sectoral Application and Regulation

- AI in Healthcare

- AI in the Financial Sector (FinTech)

- Manufacturing and Industrials

- Transportation and Autonomous Systems

- Aerospace

- Retail and E-commerce

- Education (EdTech)

- Regulatory Divergence and AGI Safety

- Regulatory Divergence

- The Question of AGI Safety and Alignment

- Conclusion

A revolution driven by AI is unfolding before our eyes. The period from 2025 to 2030 promises to be a time of exponential growth, where AI will transition from a tool for specific tasks to an essential infrastructure.

However, the near future will be defined not only by technological breakthroughs but also by structural changes and complexities – geopolitical division, energy constraints, and a fierce battle for talent.

In this material, we will examine key trends, problems supported by analytics, and provide practical recommendations for executives.

Growth of the AI Market

Overall Market and Growth Potential

By 2025, the global AI market is estimated to be approximately $300–$640 billion. The most optimistic scenarios forecast growth to $1.91 trillion by 2030 with a Compound Annual Growth Rate (CAGR) of up to 44%.

The main driver remains Generative AI (GenAI), whose market is projected to reach $97–$220 billion by 2030. Generative AI is a technology capable of creating new original content (text, images, code) based on training on large datasets, acting as a powerful user assistant (for example, in the form of chatbots or code co-pilots).

| Scenario | Forecast for 2025–2033 | CAGR | Main Growth Factor | Source |

| Optimistic | $1.91 trillion by 2030 | ~44% | Exponential adoption of Generative AI and automation of 80% of workflows. | Mordor Intelligence |

| Realistic | $1.77 trillion by 2032 | ~29.2% | Sustained demand, the development of Edge AI, and growth in the BFSI and healthcare sectors. | Fortune Business Insights |

| Conservative | $827 billion by 2030 | ~27.7% | Constraints related to regulatory uncertainty (EU) and high capital expenditures on infrastructure. | Statista |

Regional AI Markets: Comparison, Forecasts 2025 - 2030

Regarding individual regions, AI adoption will proceed in a multi-speed development mode. The speed of technology dissemination, as well as associated ethical standards and investments, will directly depend on the regional regulatory and economic strategy.

| Region | Market Dynamics Forecast (2025–2030) | Key Focus | Growth Drivers | Barriers and Risks | Leading Companies and Players |

| North America (USA) | ~33% Maintaining leadership. Growth will be driven by the massive commercialization of GenAI and vertical integration. | Mass adoption of GenAI across all sectors, optimization of hardware (AI Chips). | Intensive influx of private venture capital and record CapEx by Big Tech. | Increased regulatory scrutiny (antitrust investigations), escalation of trade restrictions (chips). | OpenAI, Microsoft, Google, NVIDIA, Anthropic. |

| Asia-Pacific (China) | ~15–28% High dynamics, narrowing the gap. Growth due to domestic consumption and AI industrialization. | Achieving self-sufficiency in chips and industrial application of AI (Manufacturing AI). | Centralized state funding and forced resource mobilization to achieve technological parity. | Inability to overcome the technological embargo on advanced semiconductors. | Baidu, Alibaba, Tencent, Huawei, Zhipu AI. |

| Europe (EU) | ~10–12% Moderate but stable growth. Growth will depend on regulatory effectiveness | Full entry into force of the AI Act, focus on reliable and ethical B2B AI (High-Value AI). | R&D funding from EU funds, formation of a single data market, and strengthening positions in fundamental research. | High cost of compliance (adherence to the law), slowing down the speed of European product market entry. | Mistral AI, DeepMind (Google/UK), Cradle. |

| Other Regions (ROW) | ~27–42% Active technology absorption. Transformation into a major consumer and adapter of GenAI. | Creation of regional AI hubs (Middle East, Southeast Asia) and large-scale automation of service industries (India). | Foreign Direct Investment (FDI) and increased government spending on local AI infrastructure. | Brain drain to the USA/EU/China; technological and financial dependence on major players. | India (IT services, development teams), Canada (Cohere, Vector Institute), Israel (Mobileye (owned by Intel), Gong), UAE (Technology Innovation Institute - TII). |

North America (USA)

- The US will retain undisputed global leadership due to technological superiority and an unprecedented volume of private capital. The key focus is the massive commercialization of Generative AI (GenAI) and the integration of its models into all business processes.

- The main drivers are record venture investments and huge Capital Expenditures (CapEx) by tech giants (Microsoft, NVIDIA), which will ensure dominance in developing advanced foundational models.

- The risks are associated with increased regulatory control (antitrust investigations) and possible escalation of trade restrictions (chip export controls), although the region will likely strengthen its position by attracting the best global talent.

Asia-Pacific (China)

- China will show high dynamics, aiming to narrow the technological gap with the US. The strategic focus is shifted to achieving self-sufficiency in chips and industrial AI implementation in key sectors.

- The driving force is centralized state funding and resource mobilization. The critical barrier is the risk of inability to overcome the technological embargo on advanced semiconductors, which will restrain the development of complex GenAI models.

Europe (EU)

- Europe will focus on moderate, sustainable growth, prioritizing regulation (the entry into force of the AI Act) and ethics (creating reliable B2B AI).

- Growth drivers are talent development and the strengthening of fundamental research funded by the EU.

- The main obstacle is the high cost of compliance (adherence to new rules), which may slow down the commercialization of innovations compared to the leaders.

Other Regions of the World (ROW)

- The remaining regions will become major consumers and adopters of GenAI technologies. The strategic focus is specialization (e.g., Fintech, Cybersecurity) and outsourcing (BPO), using AI to increase efficiency.

- Growth will depend on Foreign Direct Investment (FDI) and the buildup of local infrastructure.

- The main risk is Brain Drain to wealthier centers and technological dependence on foundational models developed in the US and China.

“The forecast is unambiguous: the global AI market is divided into three unequal tiers, and the competition is now for control over fundamental resources – Capital, Energy, and Compute.

North America retains undisputed leadership because it effectively combines two key pillars: record private capital (CapEx of giants) and access to cheap electricity. Their focus is on the massive commercialization of GenAI and attracting Talent. The main risk for the US is increased regulatory control (antitrust investigations), which may be the only brake on this speed.

The Asia-Pacific region (China) bets on centralized mobilization but faces a critical resource imbalance. Their main barrier is the need to achieve self-sufficiency in Chips (Compute). High Energy consumption for model training and Data usage for mass deployment creates an additional load on infrastructure, which is a constraining factor.

Europe will focus on Talent (fundamental research) and ethical B2B AI. The lack of venture Capital remains a problem, and the main risk is the high cost of compliance (regulation), which slows down the market entry of innovative algorithms.

The rest of the world (ROW) acts as a key site for technology adaptation, using their specialization as a source of Data for outsourcing. Their growth depends on FDI, but they are threatened by brain drain (Talent) and technological dependence on the foundational models of the leaders. The success of a region in 2025–2030 will depend not only on private capital and chips but also on how effectively the state can provide a stable and cheap energy base for its AI initiatives.” - Eric Johnson, Marketing Expert, Emerline

The Race for Talent – The New Bottleneck

With the exponential growth in demand for AI solutions, the shortage of highly skilled engineers and researchers will become one of the main bottlenecks. Regions are actively competing for personnel:

- North America (USA) will continue to attract specialists through leading universities and high-paying jobs. In addition to record corporate salaries, the country uses simplified immigration tracks (O-1 visas) for scientists with extraordinary abilities and benefits from a developed venture capital ecosystem that allows the best talent to quickly transition from academia to highly valued startups.

- Asia-Pacific (China) is investing in mass technological education and state programs to support AI talent. As part of national plans, the government purposefully funds the creation of hundreds of new AI laboratories in leading universities and offers large grants and guaranteed positions to researchers from abroad to stimulate their return to the country.

- Europe (EU) is banking on the quality of academic training. To retain talent, Europe is actively developing pan-continental research networks (e.g., ELLIS and CLAIRE) that unite leading professors and doctoral students from centers such as ETH Zurich, Cambridge, and Tübingen to compete with the US on the quality and depth of academic experience, despite lower private sector salaries.

- Other Regions of the World (ROW) are employing niche strategies to retain and attract personnel:

– Canada protects its research assets through state funding of institutes (Mila, Vector Institute) and supports simplified immigration programs for technical specialists.

– Israel relies on a powerful state "talent forge" – mandatory military service in high-tech units, which feeds the startup ecosystem.

– New hubs (UAE/Saudi Arabia) are actively "buying" talent, offering unprecedented salaries, tax incentives, and creating specialized international universities (e.g., MBZUAI) to rapidly build competencies.

Ultimately, the shortage of specialists will provoke an explosive growth in the AI education market. AI tutors and personalized programs will become the key element that will quickly saturate the market with talent and close the industry growth cycle.

Hardware as a Fundamental Resource

The Chip Market, Capital, and Vertical Integration

The need for new "hardware" has turned hardware into a geopolitical asset. The forecasted growth of the AI chip market (ASICs, NPUs, GPUs) to $165–$295 billion by 2030 (CAGR > 40%) underscores that access to computational power has become a strategic imperative.

Major players, such as Amazon, are investing up to $100 billion in their infrastructure. These colossal Capital Expenditures (CapEx) are aimed at achieving vertical integration – developing proprietary chips for maximum efficiency, which simultaneously creates a high barrier to entry for new competitors.

| Chip Category | Main Purpose | Role in the Ecosystem | Growth Drivers | Leading Country |

| GPU (Graphics Processing Unit) | Training and Inference of the largest foundational models (LLM). | Main platform for GenAI; source of monopoly advantage (NVIDIA). | Continuous growth in GenAI complexity and the requirement for high-speed parallel processing. | USA (90%): NVIDIA’s share. The remaining 10% is split between AMD (Instinct) and Intel. |

| ASIC / TPU (Application-Specific) | Vertical integration and optimization of cloud computing. | Tool for reducing dependence on third-party suppliers; ensuring efficiency. | Investments by Big Tech (Amazon, Google) in proprietary infrastructure (CapEx ~ $100 billion). | USA (90%+ of internal development by Hyperscalers): Development is conducted by Big Tech (Google TPU, Amazon Trainium) for internal vertical integration. |

| NPU (Neural Processing Unit) | Edge AI and mobile devices. | Providing instant data processing and on-device privacy. | The necessity to reduce the load on clouds and solve the problem of latency. | USA (87% in the AI PC segment): Leaders are Apple and Intel. South Korea (6-10% in the Mobile SoC segment): Samsung. China (Huawei/HiSilicon) actively competes in the domestic SoC market. |

The virtually complete absence of the EU and the low share of China in the dominant percentages (90% GPU/ASIC) is explained by two factors: the technological barrier and sanction policy. Creating advanced GPUs and specialized ASICs requires billions in investments and years of development (IP), which is the prerogative of American giants. As a result, China is forced to focus on chip substitution and optimization, and Europe—on research and regulation, while remaining a major consumer of American technologies.

Critical Barrier – Energy and Environmental Footprint

AI growth directly depends on the availability and stability of energy resources. Training large models requires a colossal, exponentially increasing volume of electricity. This factor goes beyond economics and becomes politically and environmentally unacceptable in regions with strict ESG standards.

In the coming years, companies will be forced to publish not only data on the carbon footprint but also the energy efficiency of their AI models (PUE – Power Usage Effectiveness metrics). Thus, the ability to ensure a stable and cheap energy base is a direct condition for competitiveness in creating foundational models.

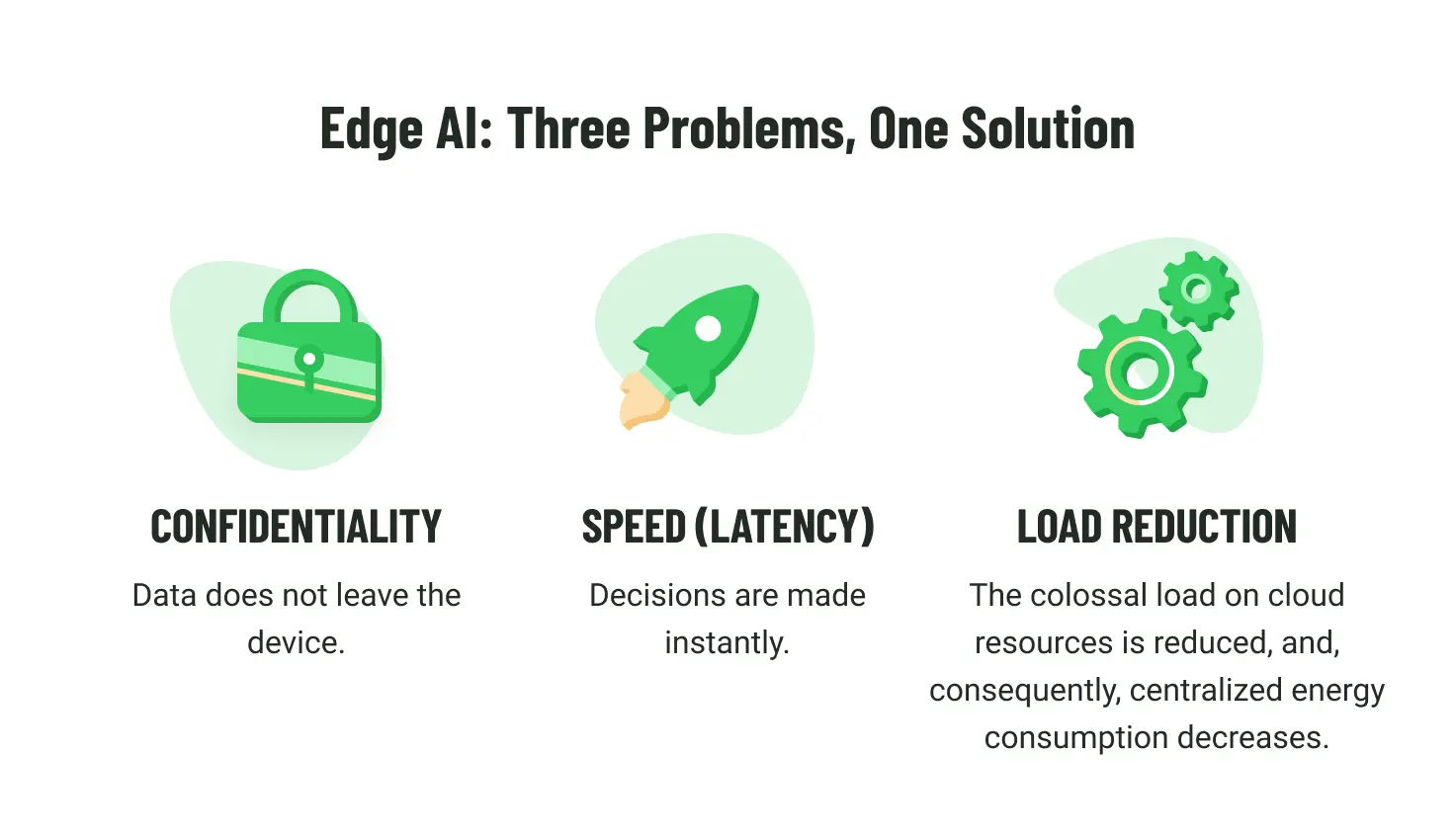

Decentralization through Edge AI

Edge AI, whose revenue is projected to grow 33 times by 2030, is not just a technology but an architectural response to these limitations. By processing data directly on the device (at the edge of the network), Edge AI solves three key problems simultaneously:

“The AI market has entered a critical phase where technological leadership directly depends on control over physical resources. Look at three key conflicts:

The Chip Barrier: The hardware market (almost $300 billion) is a race for vertical integration. Giants are investing hundreds of billions of dollars in creating their own chips (ASIC). This blocks access to resources for competitors and sharply raises the barrier to market entry.

The Energy Limit: AI has encountered a serious ecological and political constraint because large-scale model training requires too much electricity. Soon, companies will be required to publicly report on how energy-efficient their AI is to comply with standards (PUE publication).

The Architectural Response: The only solution is decentralization. Edge AI, by shifting data processing directly to the device, is not just a trend but a necessary response to the problem of reducing centralized load on power grids, while ensuring instant speed and confidentiality. In other words, the future architecture of AI will be determined not only by who writes the best code but also by who can deliver and pay for enough watts.” - Eric Johnson, Marketing Expert, Emerline

The Problem of Trust and Data Quality

Hyperautomation and Hidden Risks

Hyperautomation is the next stage of digital transformation that combines traditional robotic process automation (RPA) with machine learning and Generative AI (AI Agents). AI Agents are intended to take over up to 80% of routine corporate tasks, performing end-to-end processes without human intervention, from document processing to making initial decisions.

However, this progress faces a critical problem, often called "Data Debt". Unresolved issues of unreliability, fragmentation, and bias in existing corporate data can cause the failure of complex hyperautomation projects. The problem is that automation multiplies the scale of the error: bad data fed to an AI Agent instantly leads to incorrect financial transactions, erroneous client decisions, or regulatory violations.

The use of GenAI Agents creates new, structural risks that go beyond simple data quality:

- Risk of Hallucinations and Inaccuracies: The automated system can generate a convincing but completely erroneous result that is difficult to detect without human oversight.

- The Opacity Problem: Complex GenAI models are "black boxes". The inability to precisely track why an AI Agent made a particular decision creates serious legal and governance risks, especially in the financial and medical sectors.

Thus, hyperautomation can bring huge benefits, but it requires companies to fundamentally reorganize their data infrastructure and introduce strict protocols for trust and control over autonomous systems.

Sectoral Application and Regulation

AI in Healthcare

The AI market in healthcare will reach $187–$208 billion by 2030. The role of AI here is not to replace the doctor but to increase the accuracy and speed of work.

- Key Areas: AI systems will lead in diagnosis (automated analysis of medical images, MRIs, CTs) and drug discovery (predicting the effectiveness of molecules), with the drug discovery segment showing a CAGR of about 40%.

- Key Factor and Risk: AI systems will be subject to the strictest regulation (similar to FDA/EMA for drugs) and require maximum transparency (explainability) of their decisions, as the price of an error is a human life.

AI in the Financial Sector (FinTech)

The financial sector is one of the most mature users of AI, and by 2030, AI will solve three key tasks:

- Fraud Detection: AI will analyze behavioral and transactional patterns in real-time, reducing losses from fraud, which are estimated in billions of dollars.

- Personalized Consulting (Robo-Advisors): AI advisors will provide individual financial plans and investment recommendations, making high-quality services accessible to the mass market.

- Credit Risk Assessment: AI will use non-traditional data sources (e.g., utility payment data or purchase history) for more accurate creditworthiness assessment, expanding access to credit for the population with limited credit history.

- Key Factor and Risk: In FinTech, the main risk is related to data bias, which can lead to discrimination in lending, which, in turn, will entail multimillion-dollar fines from regulators.

Manufacturing and Industrials

AI will be deeply integrated into industrial automation processes, which is critically important for the economies of China and Europe.

- Key Areas: Predictive Maintenance (forecasting equipment breakdowns before they occur) and Supply Chain Optimization (real-time demand analysis and inventory management).

- Role of AI: Significantly reduces downtime, cuts operating expenses, and increases production efficiency. AI systems in manufacturing often operate at the edge (Edge AI) to ensure instant reaction and safety.

- Key Factor: Ensuring the cybersecurity of industrial networks, as hacking an AI system can lead to physical damage to expensive equipment or the shutdown of entire factories.

Transportation and Autonomous Systems

AI is the foundation for creating fully autonomous transport and logistics.

- Key Areas: Development of autonomous driving systems (unmanned cars, trucks) and optimization of logistics routes (AI-dispatching).

- Role of AI: Real-time analysis of sensor data (computer vision, lidars) to make split-second decisions.

- Key Factor: Safety and the ethical dilemma. Regulation requires 100% reliability. AI must be capable of making ethically sound decisions in non-standard situations (e.g., in emergency mode), which requires legislative consolidation of principles.

Aerospace

AI is critically important for expanding space programs where manual control becomes inefficient.

- Key Areas: Autonomous navigation and maneuvering (especially in deep space where communication latency is too high), real-time satellite image analysis (e.g., climate monitoring, reconnaissance).

- Role of AI: Increasing the autonomy of spacecraft and rovers, which must make decisions without immediate intervention from the control center. AI is also critically important for managing space debris and preventing collisions.

- Key Factor: Reliability and resilience to failure. AI systems must operate in extreme conditions, be resistant to radiation, and make error-free decisions, as repair or reboot is impossible in space.

Retail and E-commerce

This sector, entirely based on consumer data, is undergoing a revolution thanks to GenAI.

- Key Areas: Personalized marketing and demand forecasting. GenAI allows the creation of unique marketing campaigns for each segment and incredibly accurate forecasting of which goods, when, and in what quantity will be needed in the warehouse.

- Role of AI: Content generation (automatic creation of product descriptions, advertising texts) and virtual assistants (next-generation chatbots) for customer service. AI optimizes last-mile logistics.

- Key Factor: Data privacy and ethics. It is necessary to balance deep personalization with adherence to strict privacy rules (GDPR, CCPA) so as not to violate customer trust.

Education (EdTech)

AI is transforming both the learning process and the management of educational institutions.

- Key Areas: Personalized learning (Adaptive Learning) and administrative automation.

- Role of AI: AI Tutors will be able to adapt the curriculum in real-time to the speed and learning style of each student, filling knowledge gaps. AI also takes over the routine tasks of teachers and administration (grading tests, scheduling).

- Key Factor: Content quality and absence of bias. AI platforms must be trained on objective and high-quality data so as not to reinforce existing educational or cultural biases.

Regulatory Divergence and AGI Safety

Regulatory Divergence

The main problem is not technical development but creating a globally compatible environment. Geopolitical disagreements and fundamentally different regulatory approaches of the three largest blocs create the risk of a technological divide that will complicate the work of international companies.

| Aspect | USA (Innovation and Competition) | EU (Rights Protection and Standardization) | China (State Control and Stability) |

| Main Instrument | Executive orders, industry standards, antitrust control. | EU AI Act (mandatory, based on risk assessment). | Fast, iterative rules with strict requirements for content and censorship. |

| Philosophy | Ex-Post (Control after implementation, focus on competition and innovation). | Ex-Ante (Control before implementation, focus on ethics and safety). | Sovereign Control (Management of data and content for political stability). |

| Predicted Effect | Retention of technological leadership, but intensification of litigation. | Creation of a "gold standard" for safety, but a reduction in the pace of commercialization due to high compliance requirements. | Creation of the world's largest domestic market with unique requirements for data and algorithms. |

The Question of AGI Safety and Alignment

The discussion about Artificial General Intelligence (AGI) is moving beyond academia and becoming part of corporate risk management. Even if AGI is not achieved by 2030, highly efficient systems will require new safety protocols:

- The Alignment Problem: This is a critical challenge requiring a guarantee that complex AI systems, possessing a non-human level of efficiency, act strictly in accordance with human values and do not optimize their goals to the detriment of society. This includes the development of technical methods for "educating" AI.

- Model Governance: Companies must implement strict systems for auditing, versioning, and controlling every model used in critical processes. This is necessary to ensure Explainability, so that in case of an error, it is possible to determine why the AI made the wrong decision (especially relevant for medicine and finance).

- Red Teaming: Companies must hire specialized teams that attempt to hack or force AI models to output malicious or biased content before their commercial release, which is becoming a security standard.

“The discussion about the safety of AGI and highly efficient systems has ceased to be academic and has become a critical issue of corporate risk management. We have entered an era where technological superiority itself is not enough. The Alignment Problem – ensuring that complex AI acts in accordance with human values – is not just an ethical one but a fundamental technical task.

To overcome the ‘Black Box Problem’, companies in critical sectors (finance, medicine) are obligated to implement strict Model Governance protocols. This means creating systems for auditing and versioning, as well as using 'Red Teams' to actively search for and eliminate vulnerabilities in models before their deployment.

Ultimately: The future of the market belongs to those who can prove that their autonomous systems are not only powerful but also auditable, explainable, and trustworthy. The success of GenAI directly depends on the industry's ability to solve the problems of trust and control before moving to the next level of automation.” - Eric Johnson, Marketing Expert, Emerline

Conclusion

By 2030, the global AI market, potentially reaching $1.91 trillion, will make a fundamental transition from a set of "AI products" to "AI infrastructure". This exponential growth will proceed under the sign of three key structural conflicts:

- Geopolitical Resource Split: The struggle for Capital and Compute (the chip market at $295 billion) is the new strategic imperative, where US dominance in chip design and the colossal energy consumption of GenAI create insurmountable barriers for those lagging behind.

- The War for Talent: The shortage of qualified engineers and researchers has become the new bottleneck. The solution to the problem lies in accelerated upskilling, where Generative AI itself (AI tutors) becomes the key tool for eliminating the shortage.

- The Crisis of Trust and Governability: The success of Hyperautomation (up to 80% of routine tasks) directly depends on companies' ability to solve the "Data Debt" problem and ensure Explainability.

“We are observing a fundamental shift: AI is moving from the category of 'products' to the category of 'global infrastructure'. The main conclusion for business: Regulatory divergence forces global companies to prepare two versions of AI products. This will be 'Speed and Scale' for markets chasing pace (USA/China) and 'Audit and Security' for the European market. The necessity for two standards will inevitably increase operating costs and complicate deployment.

The takeaway is simple: Hardware is no longer an expense, but a strategic resource. And questions of ethics, data quality, and governability are no longer questions of 'good practice' but critical barriers capable of halting the growth of a trillion-dollar market.” - Eric Johnson, Marketing Expert, Emerline

In the coming years, success will belong to those companies that can transform forecasts into manageable projects. Emerline, as a partner in AI development, focuses on converting these global trends into practical solutions. Our expertise in Generative AI, the development of autonomous AI Agents, and strict adherence to regulatory standards allows us not only to follow the market but to shape it, providing scalable and auditable AI systems.

Published on Dec 4, 2025