Merchant recognition solution based on ML.

Lending Platform Transformation: Slashing Loan Processing Time by 85% with an Emerline-Developed Open Banking Powered Platform

Emerline engineered a new, data-driven foundation for our business that increased our loan approval accuracy and transformed our customer journey from weeks of paperwork into minutes of seamless interaction.

Background

For over two decades, our client established itself as a trusted mid-market financial institution, building success on customer relationships and a commitment to responsible lending. However, this traditional model was struggling to keep pace in a digital-first world. The company’s loan origination process was hampered by manual data entry, paper-based documentation, and fragmented legacy systems. This operational friction drove up costs, introduced a significant risk of human error, and created a poor customer experience.

Externally, nimble fintech startups were setting new market expectations with loan decisions in hours, not weeks. Faced with high applicant abandonment rates and the risk of losing market share, the lender’s leadership knew a fundamental transformation was necessary. They needed a strategic partner to shift from a manual, paper-based model to a data-driven, automated one. Emerline was selected for our deep expertise in the finance sector and our track record of guiding established businesses through comprehensive digital transformations.

Challenge

Manual data verification and high error rates

Fragmented underwriting and inconsistent decisions

Poor borrower experience and high abandonment

Limited market reach

Methodology & Approach

Emerline’s engagement was founded on a strategic, collaborative partnership using an Agile development methodology. This approach ensured the final product was perfectly aligned with the real-world needs of the lender's business users and customers. The entire project was anchored by a comprehensive Discovery Phase, a critical service Emerline provides to define project goals and ensure success from the outset. During this phase, Emerline's business analysts and UI/UX design experts conducted a series of intensive workshops with loan officers, underwriters, and compliance teams. These sessions allowed us to map out existing workflows, identify specific pain points, and gain a profound understanding of the nuances of their lending operations. This user-centric research formed the bedrock of our entire development strategy.

Based on the insights gathered, we defined a clear, feature-driven approach to building the new digital lending platform.

Solution

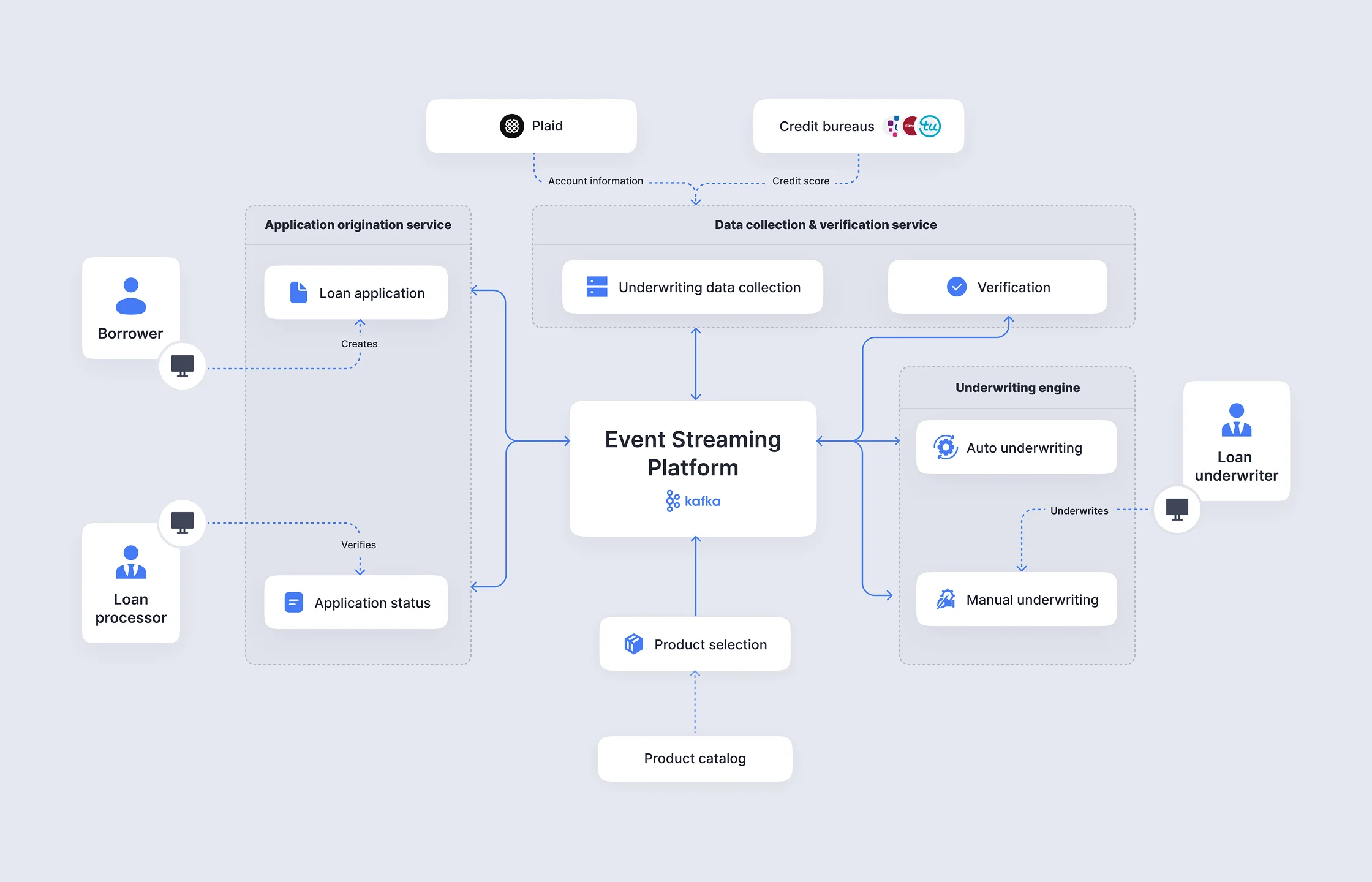

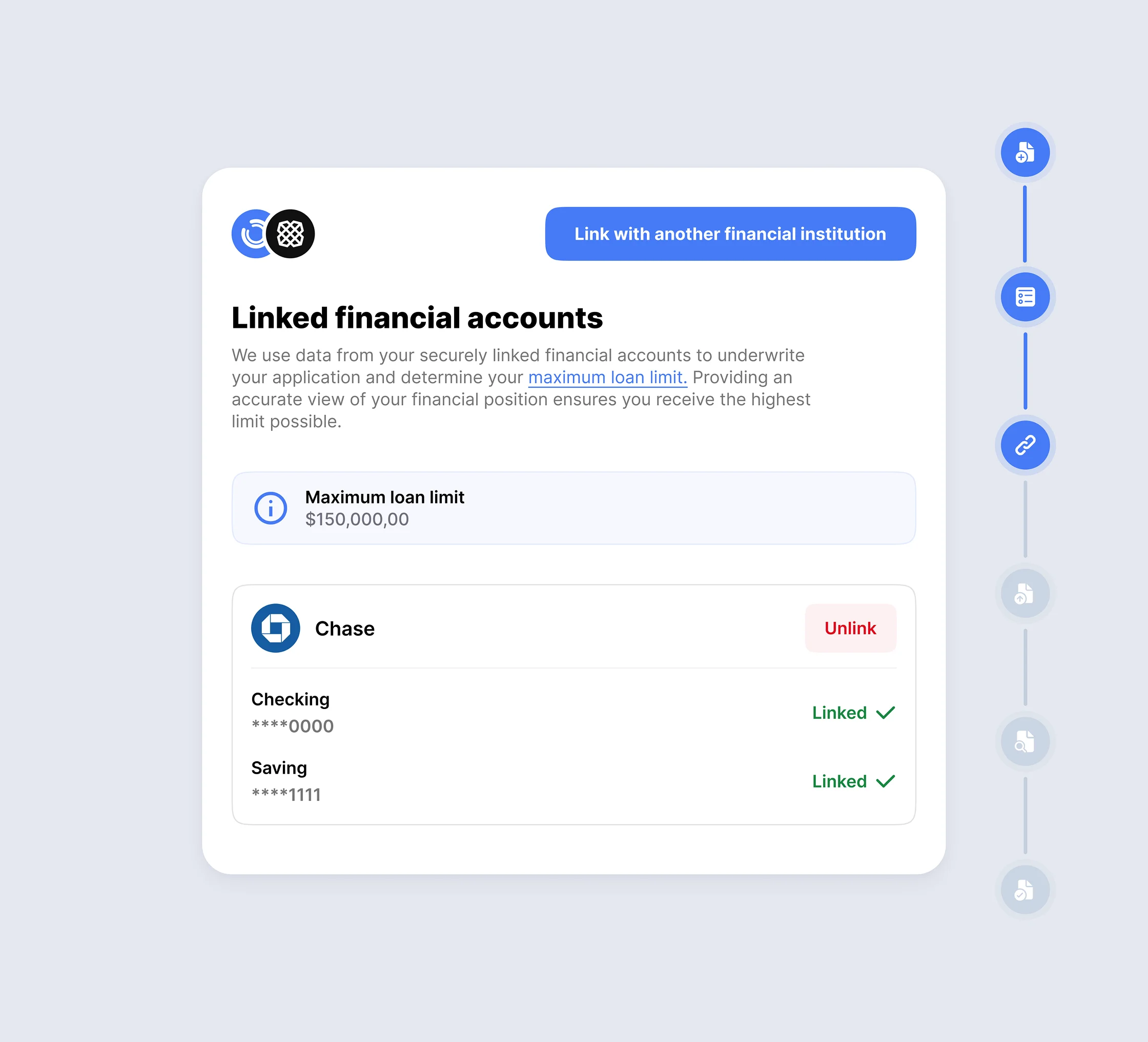

Open banking-powered data verification

The cornerstone of the new platform is its seamless integration with the Plaid API, which eradicates the need for manual document submission. Applicants can securely connect their bank accounts in seconds, granting the lender permissioned access to source-of-truth financial data. This single step replaces the cumbersome process of uploading months of bank statements, dramatically improving the user experience. The platform instantly verifies identity, assets, and income by connecting directly to payroll platforms or analyzing cash flow patterns from bank data, providing a reliable assessment of an applicant's ability to repay. This process is fortified against fraud and streamlines compliance with Know Your Customer (KYC) regulations.

Intelligent automation and decisioning engine

Leveraging the rich, real-time data, Emerline’s engineers developed a sophisticated back-end decisioning engine. This system automates core lending processes, increasing speed, accuracy, and consistency. By analyzing transaction data, the engine performs advanced cash flow underwriting, providing a holistic assessment of a borrower's true financial health. This enables the lender to confidently serve "thin-file" individuals previously rejected by traditional models. The platform also automates the setup of ACH transfers for loan disbursement and repayments, and proactively checks account balances before initiating payments to reduce failures and fees.

Technology Stack

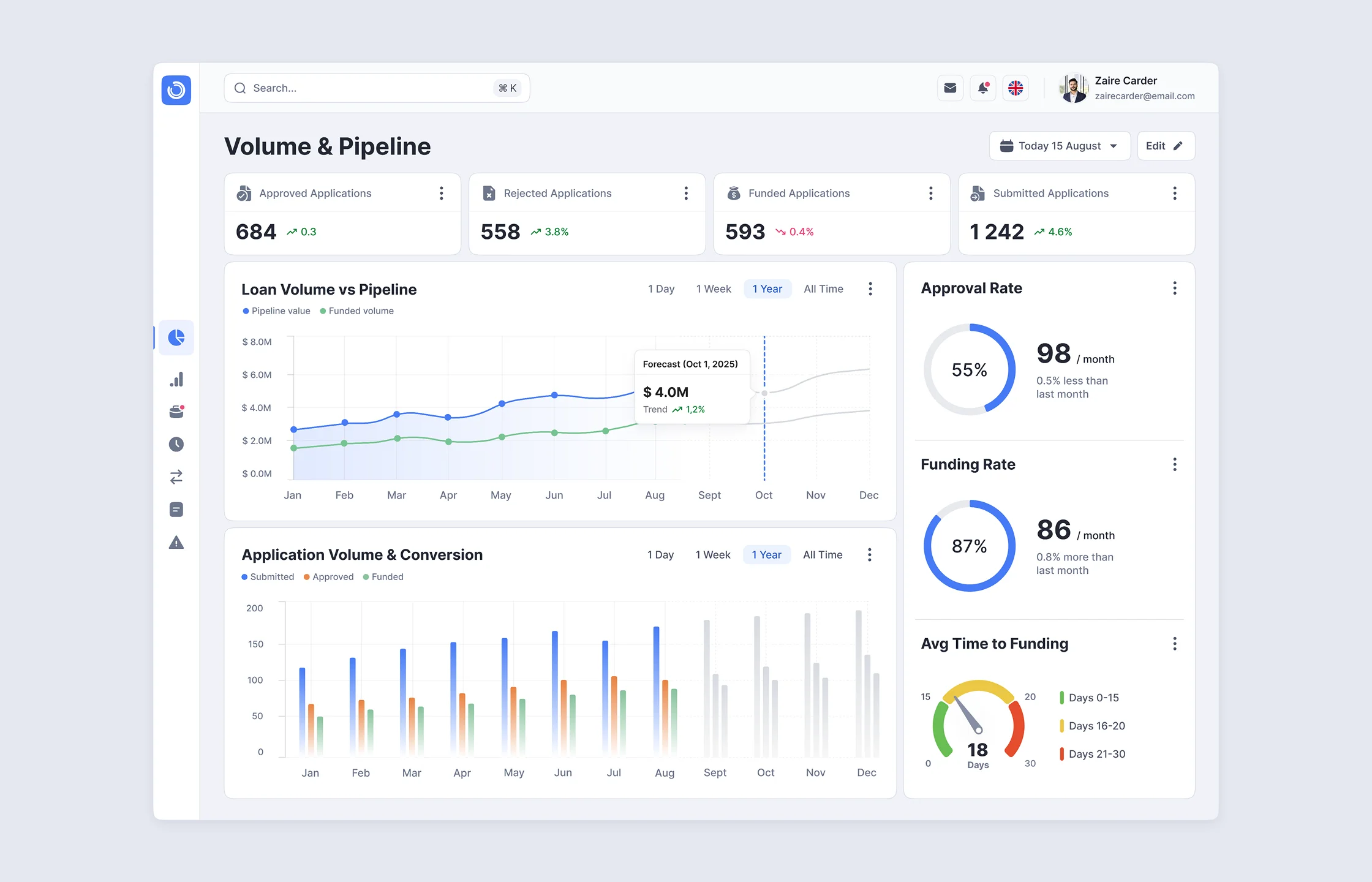

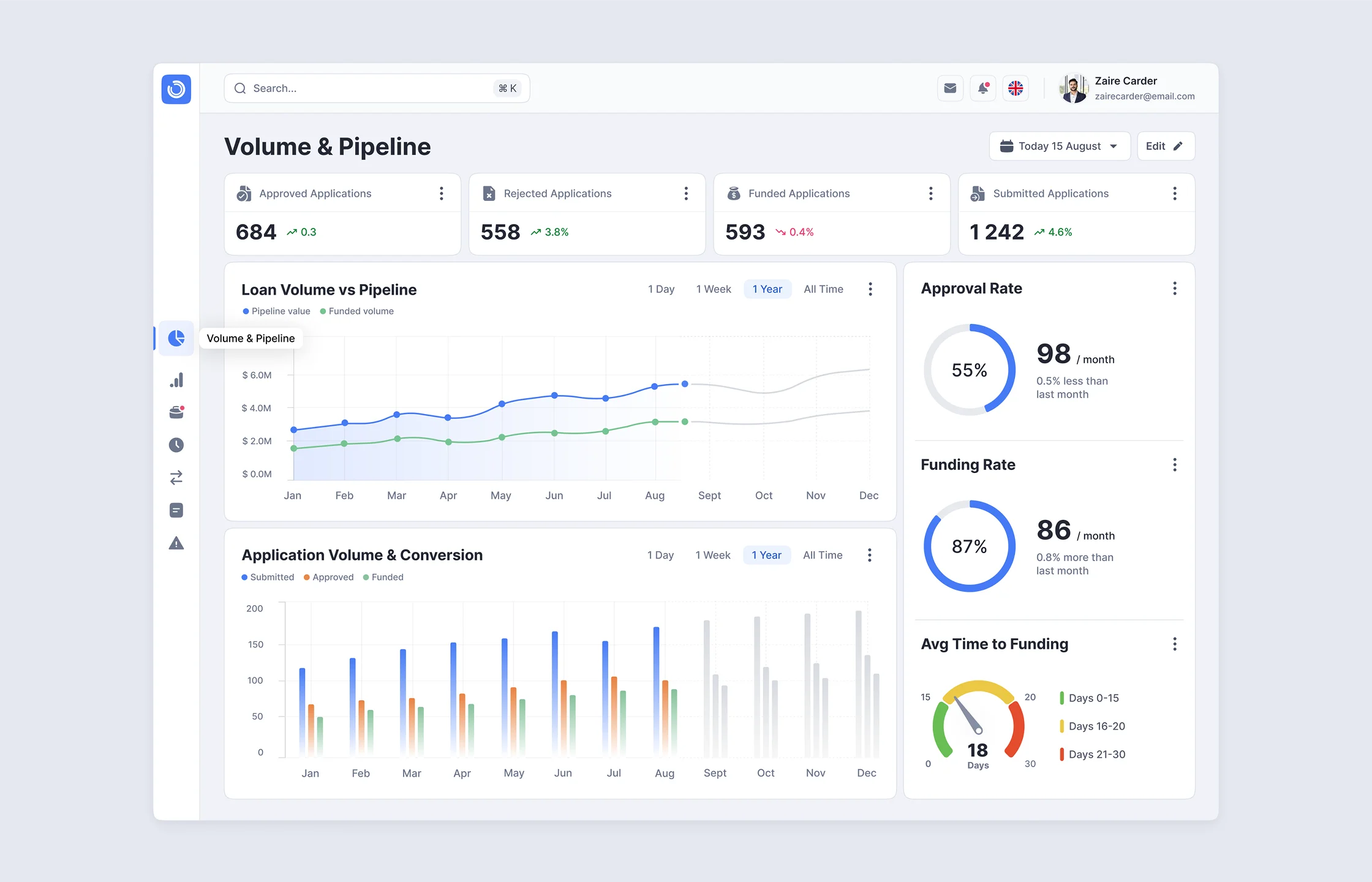

Project Results

The implementation of the Emerline-developed platform has been transformational. The project moved beyond simple process optimization to fundamentally reshape the company's business model, empowering it to operate with the speed and precision of a modern fintech leader.

- 85% reduction in loan processing time: by automating data collection and verification, the platform slashed the average time from application to decision from 25 days to under 48 hours. This allows our client to compete directly with the fastest online lenders.

- 40% increase in application completion rate: the new five-minute digital application and transparent borrower dashboard directly addressed applicant frustration. As a result, the lender saw a 40% increase in completed applications, capturing significant revenue previously lost to poor user experience.

- 25% expansion into underserved markets: the platform's ability to use cash flow underwriting opened up an entirely new market segment. By accurately assessing "thin-file" applicants, the lender increased its volume of approved loans from these demographics by 25%, fulfilling its mission to broaden access to credit.

- 60% decrease in underwriting operational costs: the automation of routine tasks freed underwriters from low-value clerical work. This allowed the lender to reallocate 60% of its underwriting resources to higher-value activities like analyzing complex cases and improving risk models, reducing costs while increasing the quality of the loan portfolio.

Smart asset management platform for optimizing IT asset management in the companies big and small. It lets businesses monitor and manage all IT assets across company facilities, schedule equipment replacements, and automate routine tasks

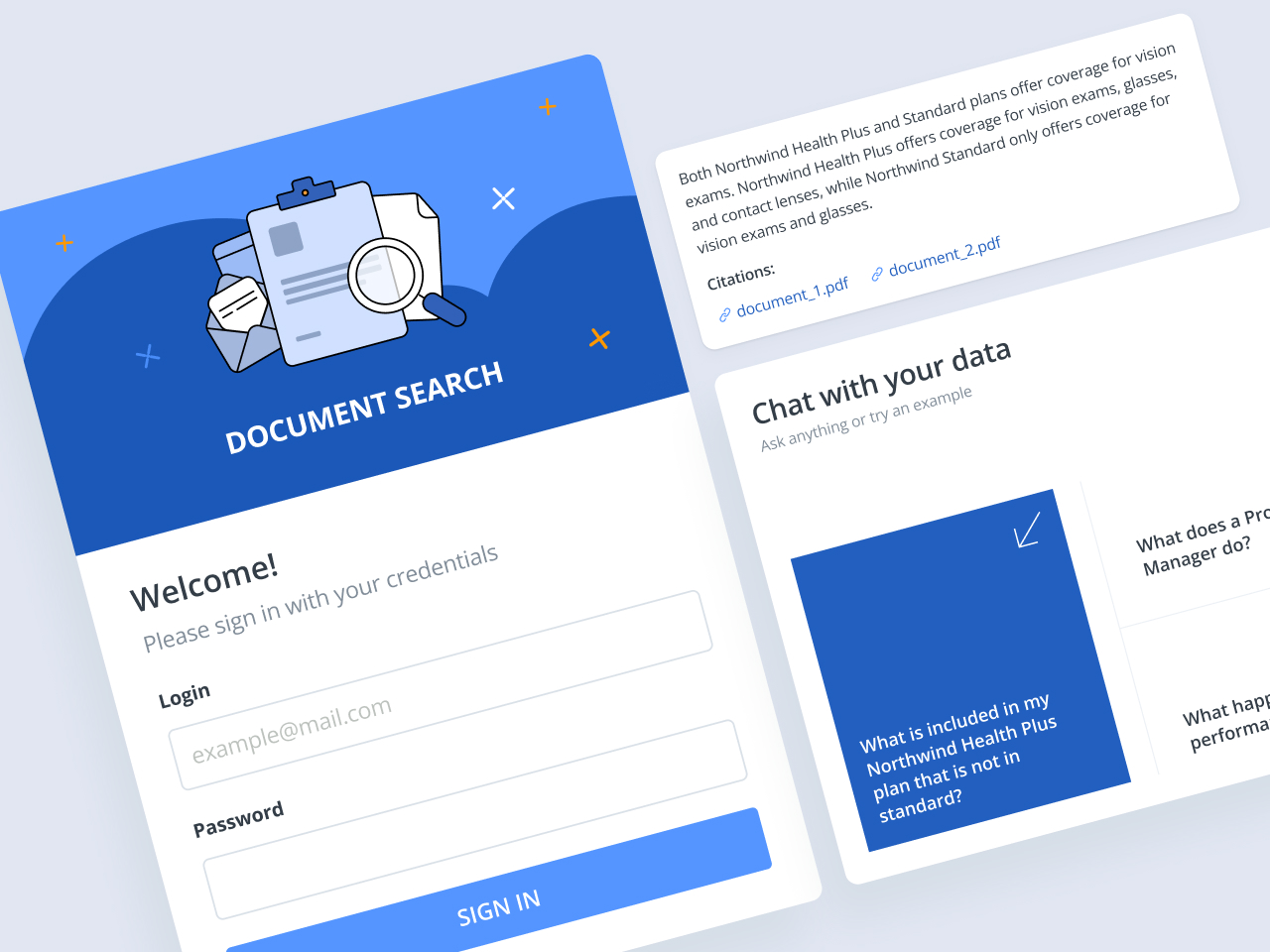

Emerline has developed an innovative AI-powered chatbot document search service tailored for B2B customers, designed to significantly enhance document management and retrieval processes in a business environment.