Transforming Global Compliance: How an AI-Powered AML Solution Increased Threat Detection by 4X and Cut False Positives by 60%

A fast-growing regional bank, overwhelmed by the inefficiency of its legacy compliance systems, partnered with Emerline to develop a next-generation Anti-Money Laundering (AML) platform. The resulting AI-powered solution transformed its operations, enabling investigators to focus on high-risk threats, dramatically improving efficiency, and significantly strengthening the bank's overall risk posture.

Background

The client is a fast-growing regional bank with a history of serving its communities for over 50 years. With a multi-billion-dollar asset portfolio and a significant presence across its home country, the institution has built its reputation on principles of stability, trust, and unwavering regulatory integrity. For an institution of its size, maintaining this reputation is not just a matter of pride; it is a core pillar of its business model and a prerequisite for its license to operate.

In the modern financial landscape, however, the institution found itself battling a confluence of escalating challenges. Like many established banks, it was grappling with rising operational costs driven by increasingly complex national regulations and the ever-present threat of sophisticated financial crime. The bank's Anti-Money Laundering (AML) framework, a critical line of defense, was built upon a foundation of legacy, rules-based systems. While these systems had been sufficient in a previous era, they were now becoming a significant operational and financial drain. The rigid, static nature of the rules-based engine was generating a tsunami of transaction alerts, the vast majority of which were false positives, consuming vast resources without a commensurate increase in risk mitigation.

The tipping point for the institution arrived not as a single catastrophic event, but as a slow-burning crisis reaching a critical mass. The board of directors issued a top-down directive to aggressively cut operational expenditures across the organization, yet simultaneously demanded an even stronger risk and compliance posture. This created a seemingly impossible paradox for the compliance division. Their teams were already stretched thin, spending over 95% of their time on the unproductive, manual task of clearing benign alerts, leading to widespread investigator burnout and creating a high-risk environment where genuine threats could be easily missed in the noise. The executive leadership realized that incremental improvements would no longer suffice; they needed a fundamental technological transformation to break the cycle of inefficiency and escalating risk. This imperative led them to seek a strategic partner capable of delivering a solution that could transform compliance from a cost center into a genuine strategic advantage.

Methodology and Approach

Strategic alignment and use case prioritization

Governance and compliance by design

Human-in-the-loop augmentation

Challenge

At the outset of our strategic partnership, we conducted a deep-dive analysis of the client's compliance operations. This discovery phase revealed four interconnected, critical challenges that were undermining the bank's efficiency, profitability, and risk posture.

Solution

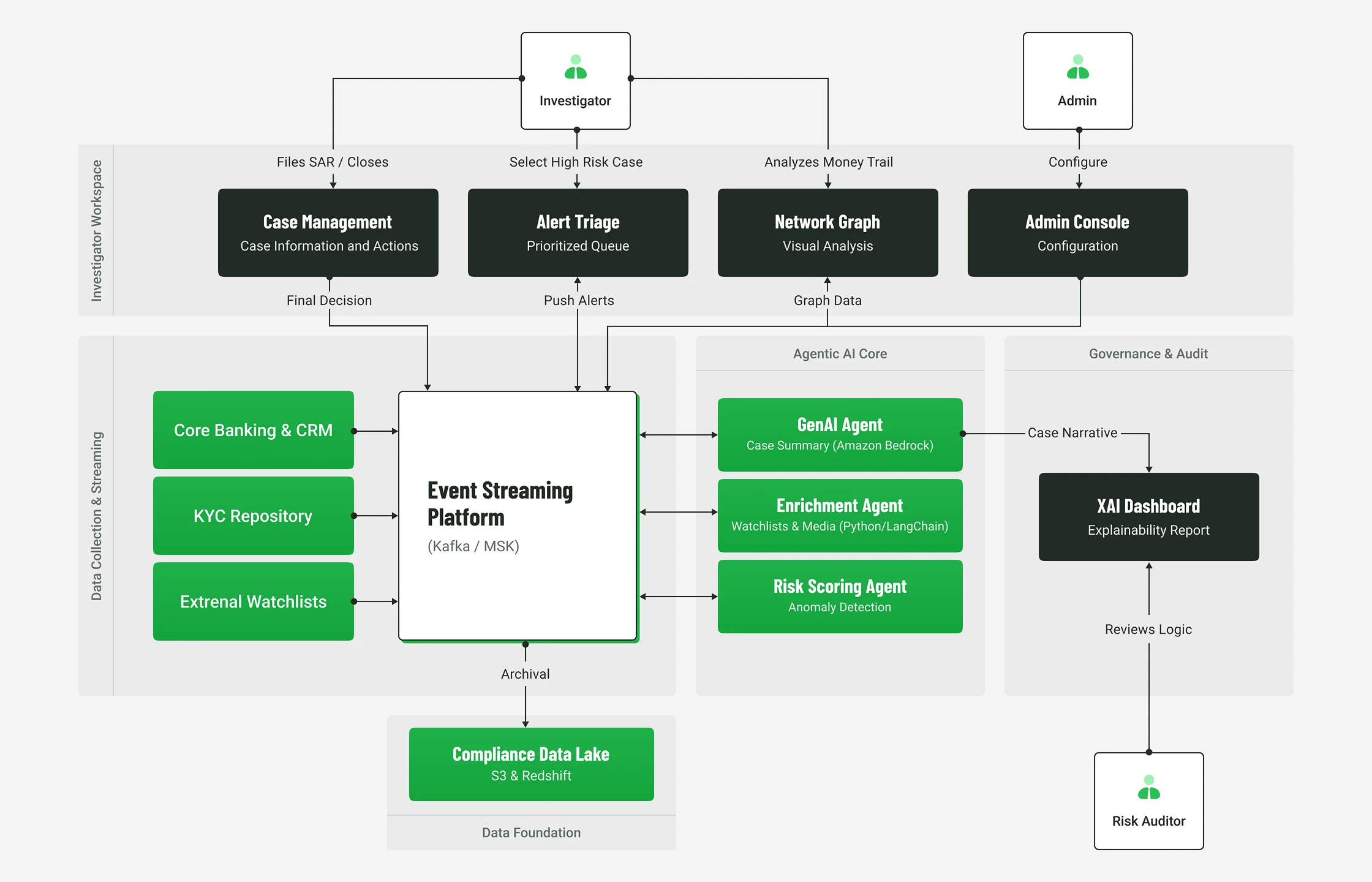

In response to the client's multifaceted challenges, Emerline developed and deployed a bespoke, enterprise-grade AI agent platform for Anti-Money Laundering monitoring and investigation. This solution was engineered to completely replace the bank's fragmented, inefficient, and rules-based legacy systems with a single, intelligent, and adaptive defense mechanism. The platform was designed not merely to improve the existing process but to fundamentally transform the bank's entire compliance function.

The agentic AI compliance platform was architected as a sophisticated network of specialized, autonomous AI agents, with each agent tasked to perform a specific function within the complex AML lifecycle. This agentic AI approach allowed for a far more dynamic, comprehensive, and nuanced analysis of risk than any traditional monolithic model could achieve. The core functionalities delivered to the client through this state-of-the-art platform included:

Dynamic, self-learning risk models

The platform's core innovation was its departure from static rules. It utilized a powerful combination of supervised and unsupervised machine learning models, including advanced anomaly detection algorithms. These models continuously analyzed billions of data points—spanning transaction histories, customer behaviors, network relationships, and emerging fraud typologies—to adapt and refine their understanding of risk in real-time. This self-learning capability enabled the system to detect novel and highly complex money laundering schemes that were completely invisible to the bank's old, rigid system.

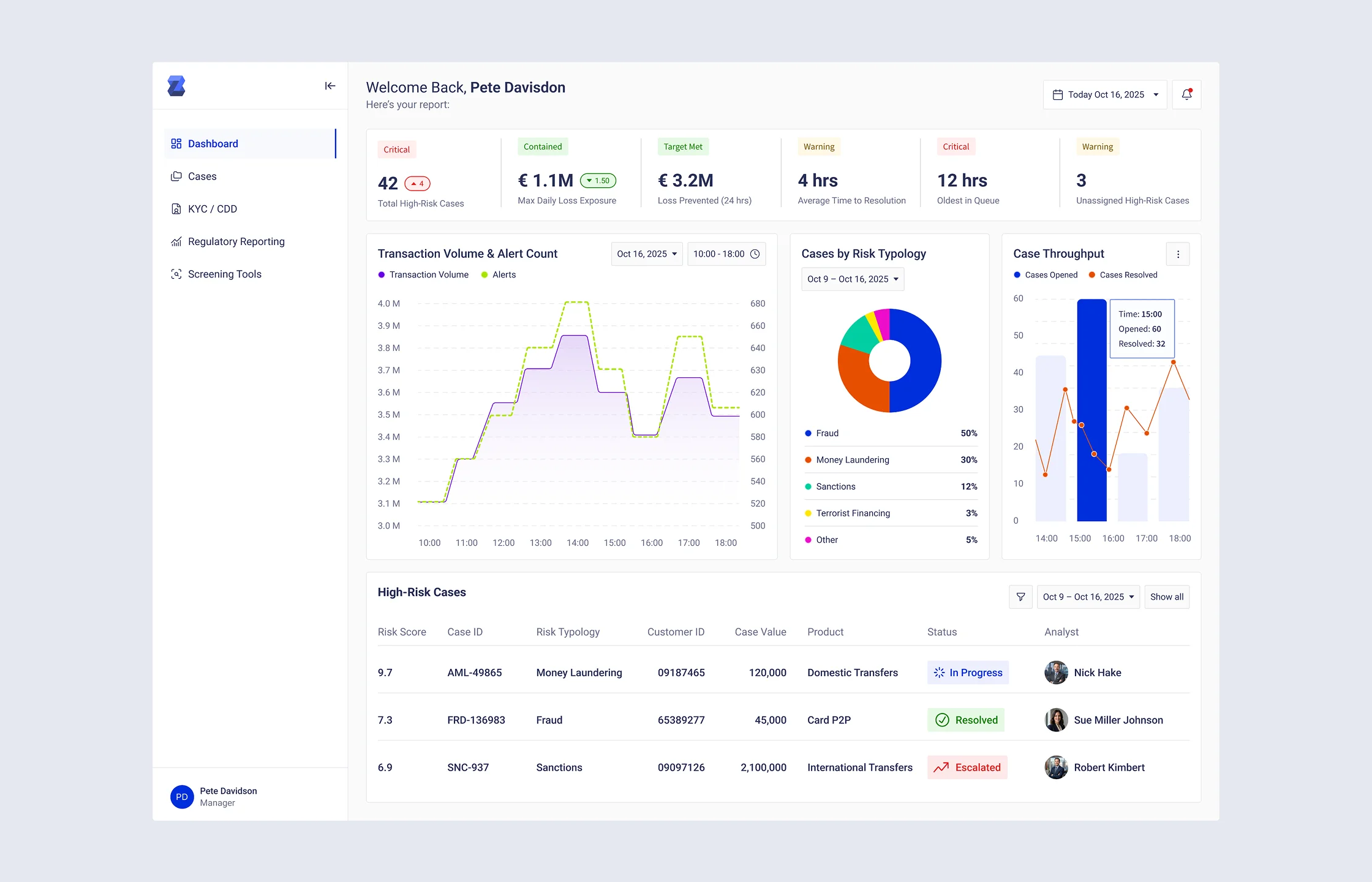

Intelligent alert triage and prioritization

Upon ingestion of transaction data, every alert was instantly analyzed by a dedicated AI agent that generated a holistic, multi-dimensional risk score. This score was calculated based on hundreds of dynamic variables, a level of complexity far beyond the capacity of a human analyst or a simple rules engine. The system then used these scores to automatically triage and prioritize the entire alert queue, ensuring that investigators always focused their valuable time and attention on the highest-risk cases first. This single feature dramatically improved the effectiveness and efficiency of the entire compliance team.

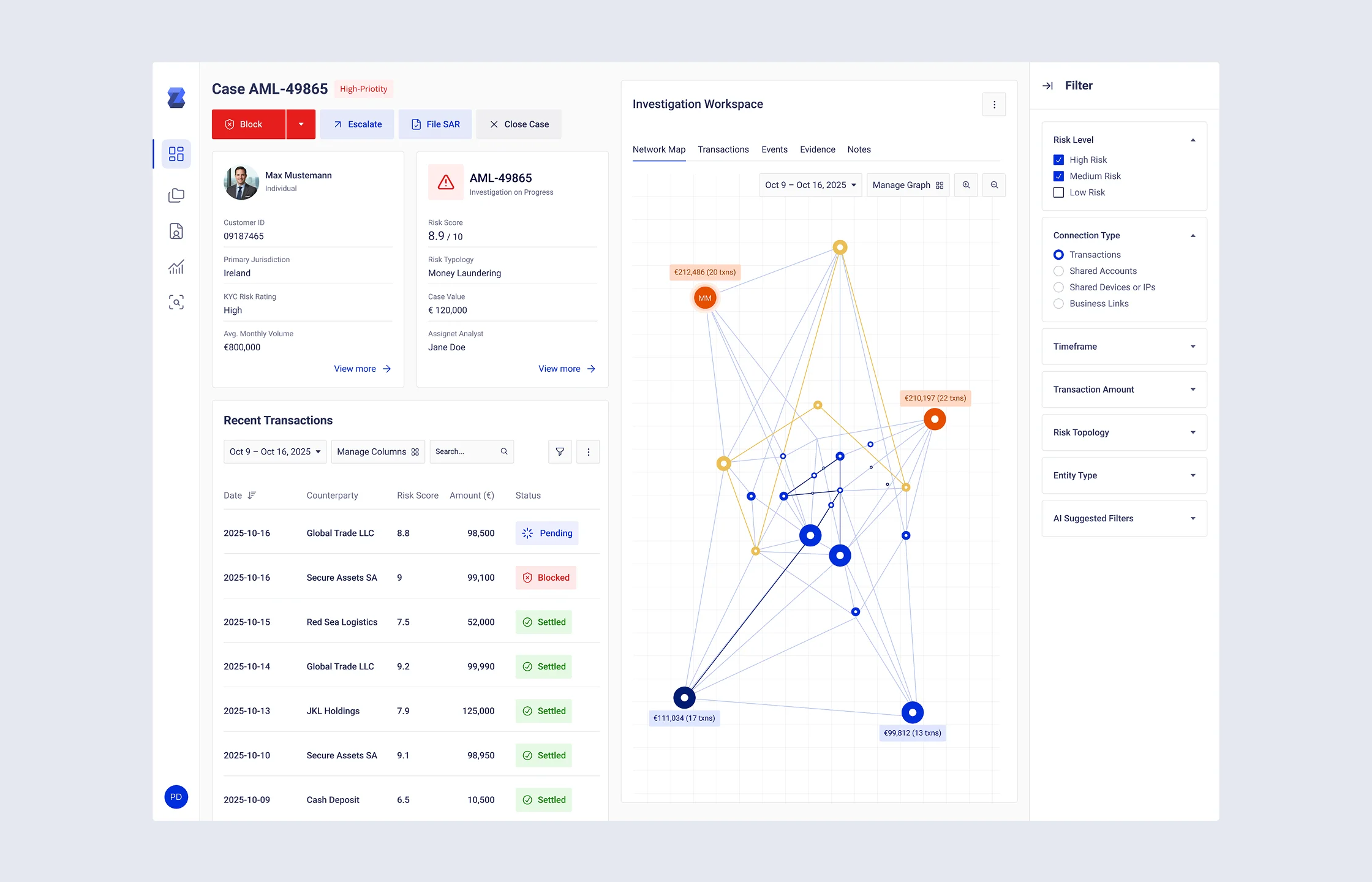

Automated contextual data enrichment

When a high-risk alert was flagged and prioritized, a dedicated "investigator" AI agent autonomously executed a comprehensive preliminary investigation workflow. It seamlessly connected to and gathered relevant data from the client's core banking platform, CRM, and KYC databases. Simultaneously, it cross-referenced all involved entities against a multitude of external sanctions lists, politically exposed person (PEP) databases, and adverse media sources. The agent then intelligently compiled all of this disparate information into a single, unified, and easy-to-read case file. This powerful automation reduced the manual research time required from human investigators by over 75%.

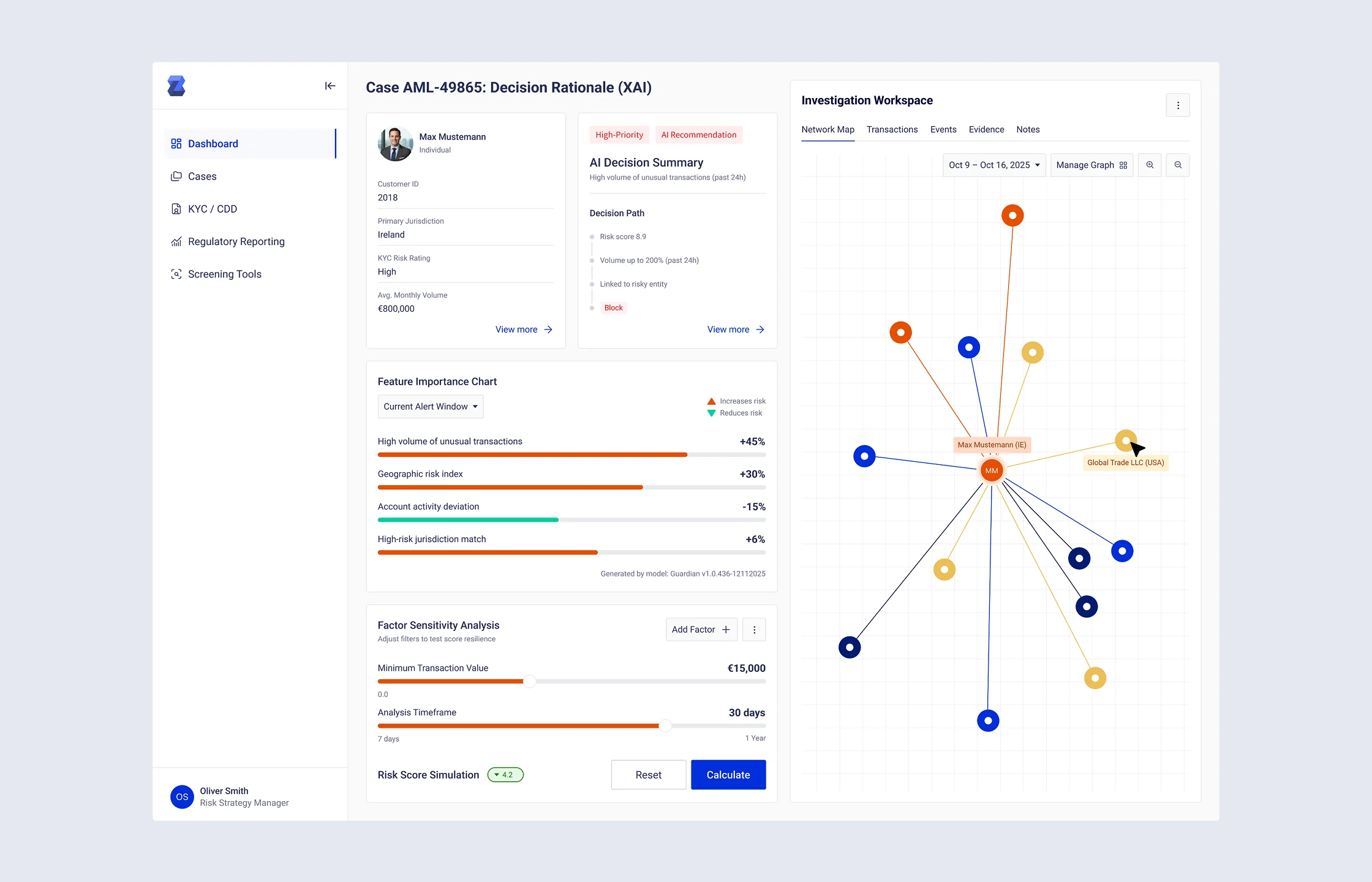

Explainable AI (XAI) investigation dashboard

A key to the solution's success and user adoption was its intuitive user interface. Instead of presenting a "black box" risk score, the investigation dashboard provided a clear, human-readable narrative for each case. It visually highlighted the specific risk factors that contributed to the high score, presented a graphical representation of the transaction network to uncover hidden relationships, and offered a summary of the case generated by a secure large language model. This level of transparency was critical for building investigator trust, facilitating faster and more confident decision-making, and ensuring the bank could confidently and clearly defend its compliance actions to internal auditors and external regulators.

Technology Stack

The solution was built using a modern technology stack, carefully selected to provide the immense scalability, robust security, and deep intelligence required for a modern banking environment.

Project Results

The deployment of the AI-powered AML platform marked a paradigm shift for the client's compliance operations. The solution successfully moved the bank from a reactive, inefficient, and vulnerable posture to a proactive, highly efficient, and intelligence-driven framework. The impact was immediate, measurable, and transformative across the organization, delivering and often exceeding every key business objective defined at the project's outset.

The crucial outcome of the project was the demonstration of how technological components work in synergy to produce a multiplicative effect on performance. The reduction in false positives was not an isolated efficiency gain; it was the catalyst that enabled the increase in true threat detection. By using AI to automate the filtering of low-value "noise", the platform empowered the bank's human experts to dedicate their cognitive energy and deep domain experience to analyzing the high-risk "signal". This collaborative intelligence model, where machine efficiency augments human judgment, was the core driver of the project's success. The following table quantifies the key performance indicators that underscore this transformation.

- Dramatically increased detection efficacy

The AI solution proved capable of detecting 2-4 times more genuine suspicious activity than the legacy systems it replaced. This remarkable improvement was not achieved by simply loosening alert thresholds, which would have increased noise. Instead, it was the direct result of the AI's sophisticated ability to identify complex, multi-layered, and low-and-slow suspicious behaviors that were intentionally designed to be invisible to the old rules-based engine. This superior detection capability led to an approximately 4x increase in the number of high-quality Suspicious Activity Reports (SARs) filed with financial intelligence units, enabling the bank to become a more effective partner in the national fight against financial crime.

- Massive reduction in operational waste

By successfully reducing false positives by over 60%, the platform eliminated the single largest source of inefficiency and cost within the bank's compliance department. This directly translated into saving over 50,000 work hours annually across the investigation team. This monumental efficiency gain allowed the client to reallocate significant budget and personnel resources away from the mundane, repetitive task of clearing benign alerts and toward high-value, proactive activities such as strategic threat analysis and complex investigations.

- Transformed investigator productivity

The platform's powerful combination of automated contextual data enrichment and the intuitive XAI dashboard fundamentally changed the daily work of the compliance team. The average time-to-decision for an alert plummeted from several hours to under 60 minutes. This acceleration effectively eliminated over 75% of the manual compliance tasks associated with a typical investigation, empowering investigators to handle a larger volume of meaningful cases with far greater accuracy, depth, and confidence.

- Strengthened regulatory and risk posture

The combined impact of higher detection rates, lower false positives, and a fully auditable, explainable AI system significantly strengthened the bank's standing with national regulators. The bank could now proactively demonstrate a highly effective, technologically advanced, and transparent approach to combating financial crime. This transformation allowed the bank to confidently reposition its compliance function from a perceived cost center into a demonstrable strategic advantage and a key pillar of its corporate governance framework.

The partnership between the bank and Emerline resulted in more than just the delivery of a new software platform; it delivered a fundamental and sustainable transformation of the bank's compliance function. By strategically leveraging agentic AI, a deep, nuanced understanding of the financial services domain, and a collaborative, results-focused methodology, we created a solution that simultaneously reduced risk, slashed operational costs, and empowered human experts to perform at the highest level. This project stands as a powerful testament to how a strategic investment in the right AI solution can generate a powerful, measurable, and lasting competitive advantage in the complex and demanding modern financial landscape.