The Ways in Which Data Science Solutions in Fintech and Banking Rock the Industry

Table of contents

- Why Does the Banking Industry Need Data Science?

- Benefits of Data Science in Banking

- Good understanding of customers leads to better product offerings

- Wide cross-sales opportunities

- Better monitoring against bank fraud

- Enhanced strategy building

- Areas in Which Data Science Contribute to Fintech and Banking

- The Bottom Line

Using data science in the banking industry is more than a trend: in recent years, it has become a necessity that allows banks to keep up with the fierce competition. Today, financial companies have realized that big data technologies can help them focus their resources efficiently, make smarter decisions, and improve performance. So this post aims at guiding you through the key advantages of data science applied to the banking industry, showing how banking companies can use these technologies in different aspects of their business, and sharing ideas on how to get the most out of data science solutions to gain an advantage over the competition.

Why Does the Banking Industry Need Data Science?

With 71% of banking users taking advantage of online banking on a daily basis and the growing amount of data generated each second, the market is full of data flows that can be used for a variety of business purposes. Analytics software has changed the way this information can be processed, making it possible to identify trends and patterns which can then be used to positively impact business decisions.

The important thing to mention here is that while one piece of data is a single data point, multiple pieces of information can create a larger picture that can be used to recognize patterns in customer behavior, purchasing choices, and other key insights. Banks can take advantage of data streams coming from payment processing services, online banking portals, mobile banking apps, and automated teller machines. Up until now, the industry has failed to appropriately manage these pools of information to their benefit.

Also, it’s no secret that processing large amounts of data requires significant resources. And with the advent of high-powered computing capability, banks are now able to harness the potential of customer data and analyze it for advantages against their competitors. In this way, analytics software solutions can empower banks and give them a stronger position in the marketplace. However, as McKinsey states, only 7% of banks are fully leveraging key analytics because they have no relevant expertise, software, and professionals.

Benefits of Data Science in Banking

Banks and credit unions are just starting to scratch the surface with regard to using insights and analytics to help improve customer experience, identify new cross-sale and needs-based opportunities, mitigate risk, and drive strategy. To make things clearer, let’s define the top benefits the banking industry can take from using data science solutions for the analysis of their data and reap the rewards.

Good understanding of customers leads to better product offerings

Analytics has a vast number of benefits, but it’s especially helpful for industries that must market themselves. Whether an institution is prioritizing cross-sales, customer or member acquisition, or customer retention, analytics becomes an essential tool for audience segmentation and wise creation of customer base. For example, the needs of millennial customers vastly vary, whether the talk is about mobile banking and fewer fees, or other features required by baby boomer counterparts. Analytics aggregates customer data and provides an in-depth, holistic picture of each customer. So lenders can quickly determine which segments are the most appropriate to target for different products and services.

Wide cross-sales opportunities

If you have ever shopped on Amazon, you’ve probably seen the “customers who bought this item also bought” section. These cross-selling efforts have increased the company’s revenue by 35 percent. But for cross-selling, it’s important to know which products and services pair well together. By compiling data and gathering insights, banks can determine where to focus their marketing efforts and which segments to target. Analytics allows an institution to be more intentional about the way it goes about marketing, and therefore, become more effective.

Better monitoring against bank fraud

Generally, customers are very loyal to their banks, and they put a lot of trust in their institutions. To avoid losing customers, as well as the financial implications, detecting and preventing cases of fraud is an important consideration for any financial institution. Broadly speaking, most fraud cases can be broken down into two categories: card fraud, like identity theft, and deposit fraud, like check fraud. Techniques used to determine fraud require recognizing patterns of people, places, systems, and events. Implementing analytical technologies can help to automate these findings, in this way greatly increasing the speed and effectiveness of fraud monitoring.

Enhanced strategy building

It’s no secret that analytics makes data digestible and informative. Financial institutions serve a variety of different customers, in different locations, with different needs. Gaining a greater holistic picture of who your customers are will not only allow targeting products and services more accurately, but it can also help to determine the overall business strategy. In a Forbes report, The Rise of the New Marketing Organization, it was noted that data-driven marketing must be an enterprise-wide effort. Like any new technology implementation, the use of analytics is not nearly as impactful if the entire organization isn’t on board. The use of analytics and insights helps bank executives to narrow down what the goals of the organization should be, as well as communicate and illustrate those goals clearly.

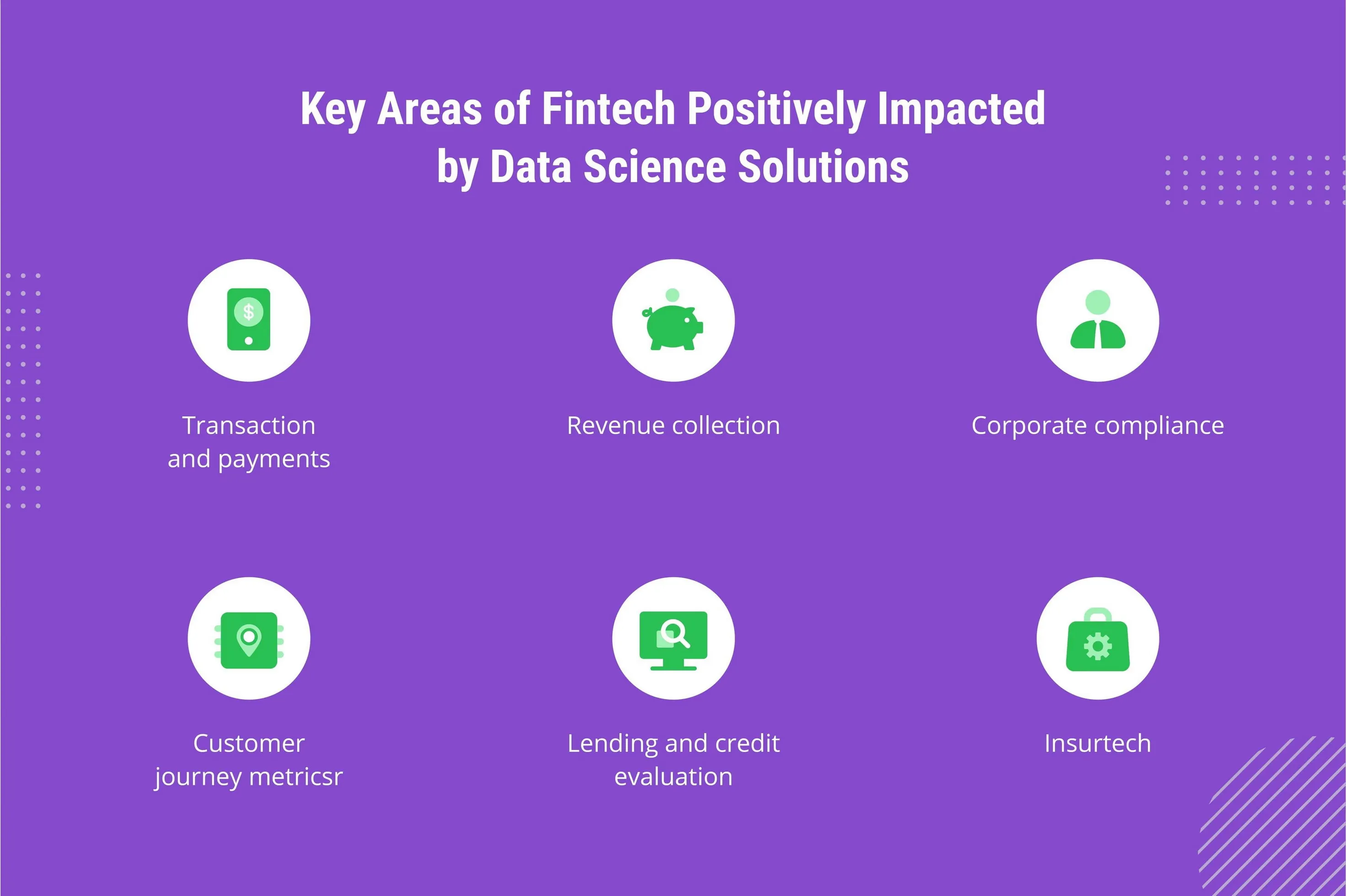

Areas in Which Data Science Contribute to Fintech and Banking

The power of data science algorithms revolutionized the business processes of financial organizations. As we have already pointed out, the use of data science solutions in fintech and banking opens up space for real-time predictions of investment opportunities and allows spotting trading patterns. The financial sector has seen these six changes as a result of using data science:

- Transaction and payments

Data analytics are used to enhance the customer experience and the product's value. Integration of personal data and payment records, loyalty rewards, etc. improves customer engagement.

- Revenue collection

Predictive models can forecast the probability of payment at the moment of purchase. So in this way, advanced insights into behavioral economics allow a more successful debt collection.

- Corporate compliance

Detecting early signs of non-compliant behavior is crucial for big financial companies, and data science ensures corporate compliance. This results in successful predictions for activities along the value chain, and successful predictions drive better service quality.

- Customer journey metrics

Most financial organizations focus on optimizing conversion rates and minimizing churn rates. Deep learning provides a structured analysis of various interaction data like social network activity, unstructured text, feedback rankings, etc.

- Lending and credit evaluation

Big data and AI models are widely used in microfinancing and other types of lending businesses to reduce the cost of credit underwriting and make loans available to a wider audience that often has a challenged credit history. This promotes financial inclusion on the one hand and results in higher revenues for the insurer on the other. In addition, the wider accessibility of instant loans helps boost the economy in general and the business efficiency of small and medium enterprises in particular.

- Insurtech

A lot of insurance companies still don’t use available data insights to create their products and services. On many occasions, they rely on demographic and statistical data that is outdated and no longer relevant. Because of this, they have a hard time setting optimal prices on their policies and often miss out on substantial financial opportunities that simply get overlooked. Modern insurance companies take full advantage of big data and actively use machine learning to create highly customized, low-risk insurance offers that address the specific needs of particular categories of users.

The Bottom Line

Besides everything mentioned above, data science also helps fintech businesses in asset management, portfolio optimization, employee retention, and more. With companies finding newer ways to implement data science into their business, the future looks more promising for the fintech sector. And here’s how we at Emerline contributed to the more effective attraction of relevant audiences and maintenance of the desired level of customer retention for a company that works with European Banks.

Our team was involved in the development of a data science solution aimed at providing European banks with detailed, categorized information about the use of their products — debit and credit cards. The goal was to establish a mechanism that would automatically detect valuable information for banks about merchants based on payments of their customers and then split this data into categories. In this way, a bank would be able to determine who are their key merchants and receive insights into their customer behavior.

Promptly addressing challenges during the development, our team provided the client with a well-thought-out solution that allows gathering important information about their customer behavior and merchants. Having such a system at hand, the client can strengthen their position on the market of data collection service providers, offering it to banks for the extraction of useful insights. To learn more about the solution, feel free to check out our portfolio, where you can also find information about a sales analytics platform and create a clearer picture of our expertise in data science solution development. Also, you can get acquainted with more services we offer to the fintech sector here.

And for sure, we will be happy to answer all of your questions related to data science application development for banking, show you more relevant cases, provide you with a list of technologies we work with, and consult you on your project upon your request.

Published on Feb 8, 2022