Online Banking: How to Ensure the Excellent Customer Experience

Table of contents

Customer experience is the new buzzword in the business sphere, and for good reason. Every sector is now focused on providing an excellent and sometimes extraordinary customer experience to gain more clients and retain them, and for sure, the financial sector is no exception.

Customer experience is particularly important in banking because there are hundreds and thousands of options to choose from, and when it comes to the world of finance, people tend to be very careful about their choices. So while in other areas of life a person can try some new product to find out if it suits their needs, in banking things are different and are often associated with higher levels of selectivity. So, in such a competitive environment, best customer experience service banks have to invent and offer fintech solutions that their competitors can’t, or at least show that products and services they have on offer are better than anywhere else. And there are some great ways to achieve that.

In this article, we will look at customer experience in banking from different angles, in an attempt to show you various paths to provide your audience with outstanding experiences, catch an eye of those who are in search of providers that leverage digital banking trends, and allow you to be confident in high customer retention rates.

Banking mobile apps: 7 features for enhanced customer experience

Why do some mobile banking applications get high scores in ratings and consumers’ love while others are flooded with criticism and angry comments? The answer lies on the surface: innovations and a customer-centric approach.

Below, we provide you with the most wanted and innovative features that will pay off mobile app development services.

Peer-to-Peer payment systems

With the help of Peer-to-Peer payments (or Person-to-Person payments, or P2P), your customers may send or request money directly to each other with only an app. In contrast to money transfer to a bank account, which can take a couple of days, P2P is almost an immediate process that gives the customer a kind of independence.

PayPal dominated the market for more than a decade using this technology, but now more and more banks and credit card companies are willing to use person-to-person payments.

Budget & money planner

Today, the market is full of applications that allow you to monitor your budget. So why not include this feature in your banking application? It will give customers insight into their spending habits, and such seemingly small things will help you increase brand loyalty.

Context-aware notifications

With context-aware notifications, you can make your customers feel like your app helps them with their lives. To do so, ask yourself a question: “What do our customers need and what is their situation?” and provide them with some solutions, whether it's a discount for traveling, shopping, whatever. The tip is to walk the boundaries between banking interactions and customers living their lives.

Image recognition

Image recognition offers extra convenience to customers: with this feature, there is no longer the need to visit a physical branch of the bank to open an account. A person using your app can just take a snap of a passport or any other document required and upload its picture to the banking app.

Innovative technologies for banking web apps

Modern web technologies allow financial organizations to look at their customers from a different perspective. Today, by applying a set of different techs to web applications, businesses can reinterpret how people consume financial services. Below, we provide you with the top 3 innovations that induce new standards in banking.

Open banking

Open banking doesn’t just mean that banks are becoming open. It’s more of a change in their operational and business model. And here’s a simplified explanation of what open banking means:

Let’s assume a company has access to somebody’s spending habits and financial history. This data can be analyzed to conclude their customer profile which, in turn, can be used to create more customer-centric services. In other words, it means the transition from hypothesis-based to data-based product development, which results in higher levels of customer satisfaction.

Blockchain

Transferring money from one card to another is simple: it requires just a few taps. The process of transferring money between different bank accounts is a bit more complex but still doesn’t require much effort. But when it comes to international transactions, they tend to be time-consuming and often include intermediaries who charge extra fees for the services. So, companies that leverage blockchain in their web apps can reduce the number of involved parties, thus significantly reducing the costs of transfers. What’s more, in addition to the elimination of hidden costs for the customer, blockchain can help financial organizations to optimize operational processes. With blockchain, such time-consuming and error-friendly processes as digging into the archives and juxtaposing tables with complex numerical data become a thing of the past and employees can focus on other important tasks.

Other benefits of using blockchain in banking are pointed out below.

Microservice architecture

In order to implement open banking, blockchain, and other good things such as AI, banks that use legacy systems have to completely transform their technical infrastructure or create it from scratch. Nowadays, banks are spending 73% of their IT budgets on the maintenance of legacy software. Often, because of incompatible architecture, the software remains untouched rather than being merged with new technologies, which results in several systems with duplicate functions that aren’t consolidated. And this limits their usefulness. So, the solution for this is to build up systems that are easy to change - microservice architecture.

Other innovations that add to enhanced customer experience in banking

Having a Research and Development department that deals with the latest innovations, we at Emerline know the real value of implementing such advances into business processes. Innovations create a brand new reality for digital banking that redefines the way people perceive their finances.

A forward-thinking bank should stay at the epicenter, embracing technologies that satisfy customer needs for financial health, wealth, and trust. So what are examples of such techs and their use in banking? Let’s see.

AI

While AI is not new to banking, the technology is maturing, bringing the potential for higher-complexity solutions that generate positive ROI across business segments. Artificial intelligence in banking opens up space for such useful and desired by customers features as chatbots helping with the variety of tasks, predictive analytics that provides efficient money management, data science that allows banks to receive useful information for the personalization of services, and more.

If you are interested in learning more about the use of AI in banking and seeing some brilliant use-cases of the technology, you are welcome to read our recent post on the impact of AI on the digital banking landscape.

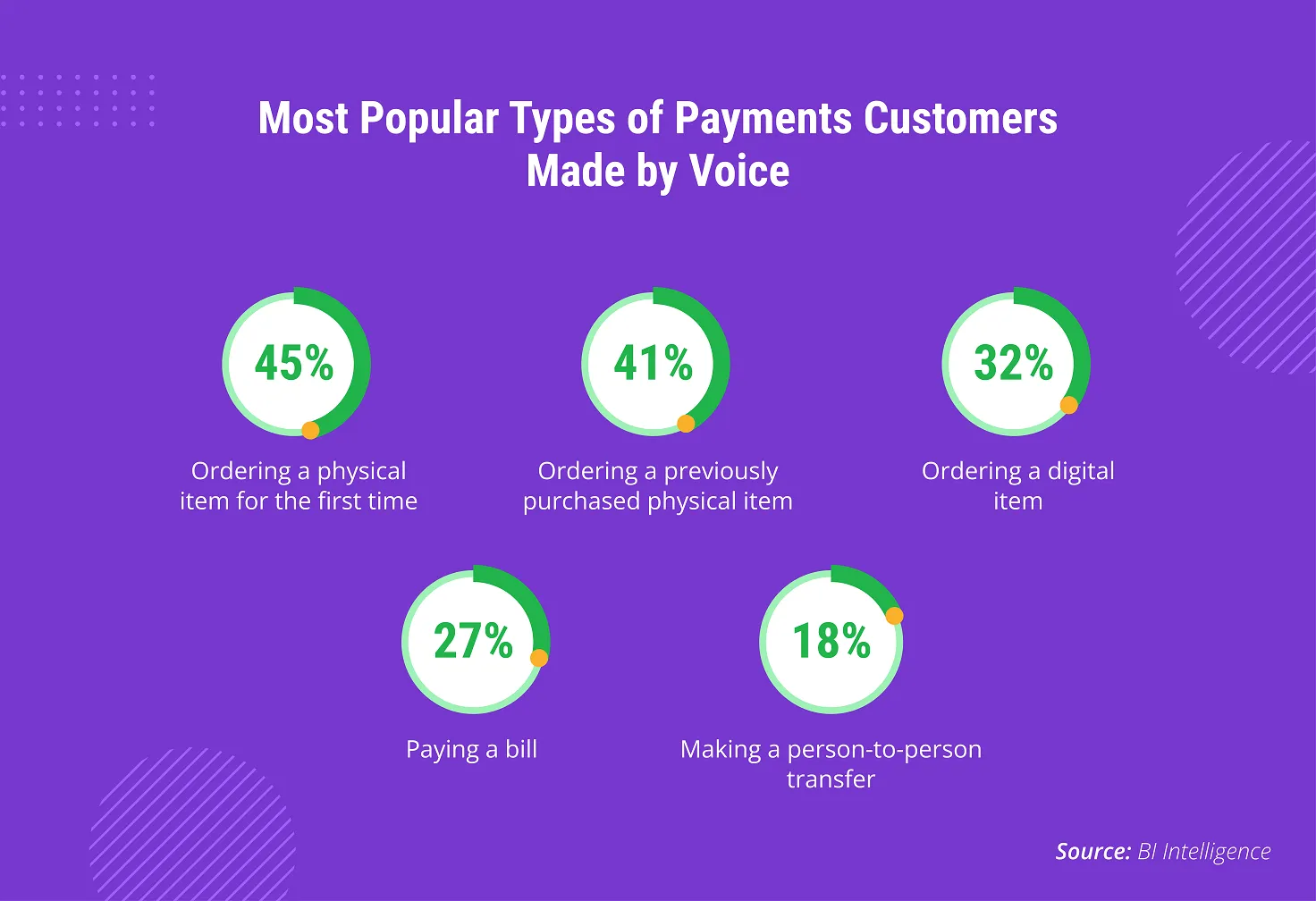

Voice technology

Even though voice payments have not yet received sufficient distribution, they will be the next banking channel to take off. A 2017 research by BI Intelligence states that 8% of US respondents used voice commands to buy something, send money to a friend, or pay a bill.

Relying on these data, we can safely say that the introduction of such a feature as voice payments will significantly expand your clients’ pool. If you need more evidence to support this claim, know that the technology is used by such trusted organizations as the Royal Bank of Canada and (UK). They became the early adopters of this relatively new technology and now their customers have an opportunity to pay their bills simply by asking Siri.

And there are far more use cases of voice payments.

AR/VR

While there is still some time before AR and VR truly evolve in finance, they have already started to make an impact. The existing use cases include:

AR/VR for data vizualization

The use of these technologies makes it easier and faster to visualize and organize large amounts of data. For example, Fidelity Labs, a part of Fidelity Investments, has created a virtual world called “StockCity”. There, stock portfolios are turned into a virtual 3D city, so investors can immerse themselves in the data.

VR payments

MasterCard has partnered with Wearality to create a world where consumers can make purchases without leaving the virtual world. They have a virtual reality golf experience called ‘Priceless’ and players are able to buy clothing right in the virtual world.

AR for customer service

Some banks, such as Turkish Akbank, have AR apps that help customers find the nearest banks and ATMs. When in a city, customers can scan the area with their phones and see real-time information about location, distance, and services at nearby banks.

To conclude, we must say that while one of the main goals among banks is to increase profits and brand loyalty, the key to achieving these good things is in the provision of quality customer service, and in modern times, it largely depends on technologies you choose for your applications. So whether you need some advice on which tech to choose for your fintech product development, or already have a sound idea and need experienced heads and hands to make it come true, we are always here to help you! So feel free to contact us at any time.

Published on Mar 30, 2022