Mobile Banking During the Pandemic: Overview of the Customers’ Wants and Needs

Table of contents

The pandemic served as a facilitator of digital transformation in many areas of the economy, with the banking and finance industry being no exception. In the world we all live in today, in case a customer can't visit a bank because of quarantine measures, the bank and its services are still accessible, in the convenience of a mobile app. But what does this app look like?

This post aims at showing you what mobile banking is today and how to build a sound app that will make a difference to users.

Keep reading to find the latest statistics on the adoption of banking apps and learn how to make things right during mobile banking app development.

A Bit of Mobile Banking Statistics Impacted by the Pandemic

As the Liftoff report states, the 2019 year witnessed an enormous increase in the number of accesses to banking services via mobile apps. To be exact, there were over one trillion accesses worldwide, and the percentage of registered users has increased to 71%. And the growth didn't stop there: for example, in the US only, users spend about 35% more time in their banking apps. What's more, there are also Japan and South Korea that saw remarkable growth estimated at 85%. And the most interesting thing is that such increases are no longer shocking. Why?

It is because due to the pandemic and the preference shown to the digital forms of services by users, ATM cash withdrawals and footfall at physical banks saw a dramatic decrease. Meanwhile, such area as e-commerce with contactless payments has increased in popularity. So banks no longer doubt if they need mobile solutions.

If you want some proof of that, the Sydney Morning Herald states that, compared to 2020, the use of ATMs in 2021 has dropped by nearly 40% in volume. At the same time, contactless payments have increased by 65%. What's more, an Australian debit card provider Eftpos claims to have a 400% growth of its mobile payments business.

So there’s no doubt that mobile banking apps are and will continue to be in demand. The question is, how to build a good app that will provide your customers with the convenience in use and ensure your business success.

Let’s try to find the answer to this question by looking at the changed face of mobile banking must-have features.

Must-Have Features of Mobile Banking Apps in Different Demographic Segments

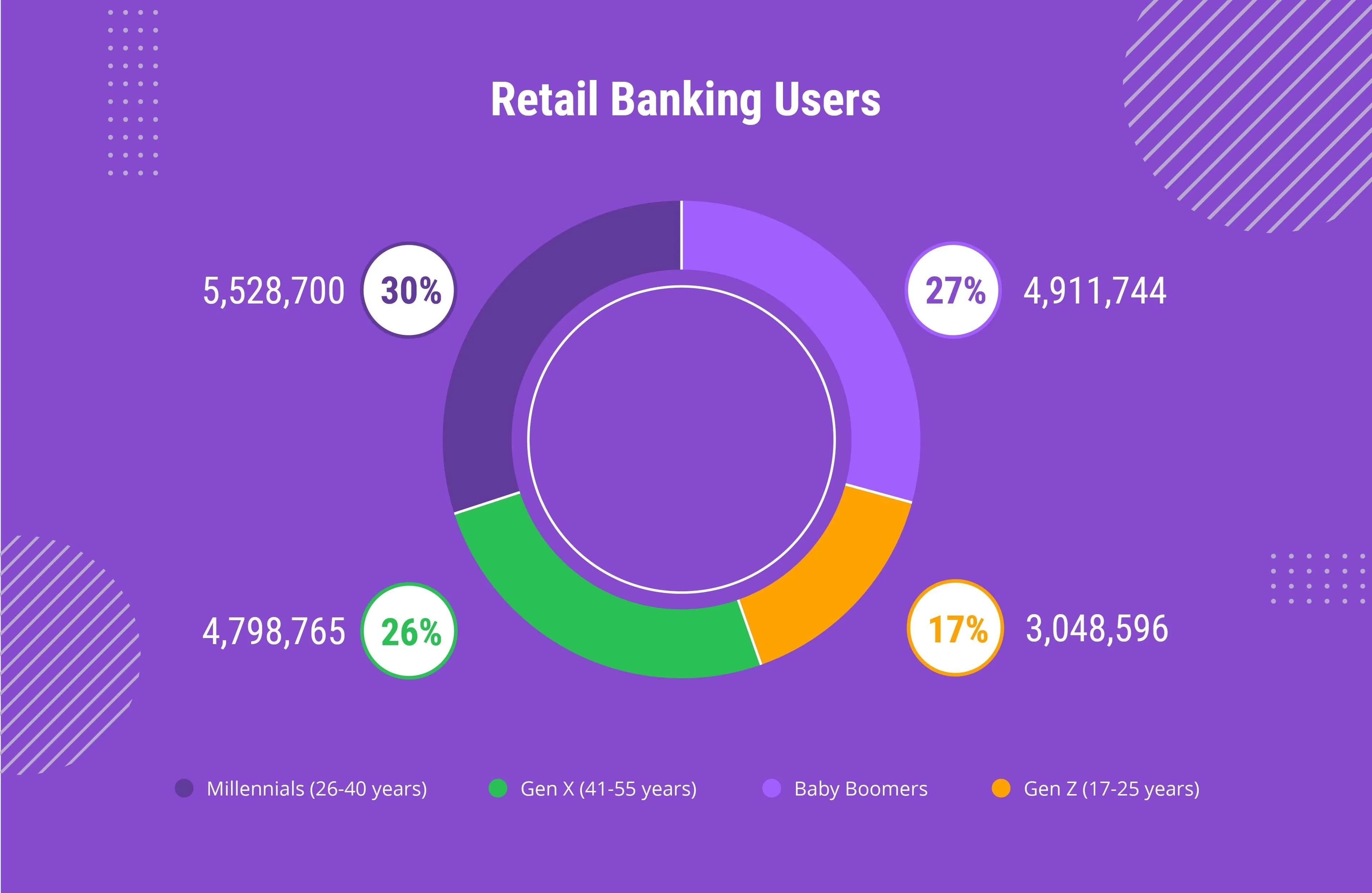

One of the best ways in which banks can easily identify their customers' wants and needs, as well as see whether there are any gaps in the existing offerings, is by looking at mobile banking from the perspective of different demographic segments. The key segments to consider are:

Baby Boomers

27% of all customers belong to this segment, and the most important thing to know about it is that its representatives are not as tech-savvy as other groups. Because most of their lives these people adhered to the traditional banking model, quite often they can seek advice on the use of digital banking from their younger family members and friends. Nevertheless, this segment is known for using mobile banking services that have to provide them with:

- Access to bank accounts

- Access to superfund accounts

- Bill payments

- Loan payments

- Lifestyle expenses funding

So are there any nuances of dealing with this segment? For sure, they are. The group of customers is associated with the highest rates of concern regarding security issues. For this reason, banks have to provide tutorials and virtual assistance, whether the talk is about web or video chats, on how to use mobile banking securely.

Gen X

Being at the peak of the income, the segment is focused on the following possibilities of mobile banking:

- Viewing accounts

- Bill payments

- Funds transfer

- Loan and credit payments

- Active money management

Because this group comprises 26% of the population, which is more than a quarter of all possible users, banks have to carefully cater to their wants and needs. What are they? The talk is about digital credit, money management, financial insights, and usability. What's more, it will be wise to consider the implementation of a virtual assistant to help the less savvy digital users in the accomplishment of their goals.

Millennials

The most technology-advanced of all groups, millennials, are looking for such banking services as loans and mortgages, saving and investment opportunities. So what are the main needs of this segment?

Gen Z

For now, being the smallest group of mobile banking users (17%) because they are just on their way to footprint the professional world, Gen Z representatives are highly digital savvy and open to trying various innovative features. To ensure the loyalty of this segment, representatives of the banking industry need to focus on a personalized, self-service approach.

Another important note is that this segment (along with the Millennials) is the future income generator for banks. So getting a clear picture of the individual customer’s behavior, preferences, and needs in future tools is crucial and can be done via sophisticated AI and ML technologies.

To offer experiences and deliver marketing messages to this group, banks can also take advantage of such technologies as chatbots.

The Common Thread: Security Issues

The Federal Trade Commission (FTC) has warned Americans about COVID-19 scams that may target money of all demographic populations during this already confusing time. The warnings are touching everything, from offers for vaccines to fake charities and traditional email scams.

So what are the security procedures in mobile banking apps that are on the rise today?

Having these features in place means that your users don’t have to constantly worry about whether their mobile banking details are in danger, and that’s what really matters for the modern mobile banking audience of all demographic layers.

We hope that this article allows you to create a picture of what mobile banking users are expecting today. And to make things even more straightforward, we decided to provide you with a real-life example of the mobile banking app created by our teams during the pandemic.

Mobile Banking App Aimed at Reducing Unjustifiably High Bills for Banking Services

During the pandemic, our team was involved in the development of iOS and Android mobile apps that complement the customer’s web solution for uploading and tracking bills for banking services. The key idea behind the app was to provide end users with the opportunity to negotiate down the cost of banking services from any device with the following features:

- Instant upload of bills for banking services

- Tracking of specific customer issues related to the interactions with financial institutions

- Storing attachments (details of the banking services provided to the end user of the app)

- Independent bill review and feedback from a customer representative via the solution, either web or mobile

Having this solution in place, our customer gained the opportunity to reach a wider audience, as two versions of the solution, both web and mobile, became available for the end user's convenience.

Having rich expertise in the development of mobile banking apps, our teams have assisted a multiple of clients in the provision of sound financial solutions. And if you’re interested in how we can help to make your brightest tech ideas come true, we are always here to help you.

Published on Jun 12, 2023